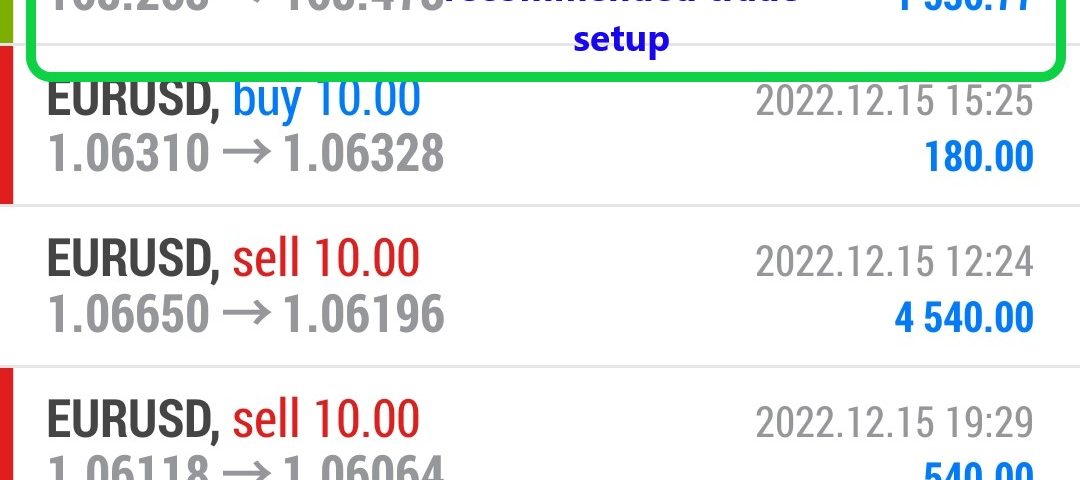

Forex Smart Trade Results Thursday, Dec. 15, 2022 – $4,857

Forex Smart Trade Results Wednesday, Dec. 14, 2022 – $2,439

December 17, 2022

Forex Smart Trade Results Friday, Dec. 16, 2022 – $9,006

December 17, 2022How fast are trades executed?

How fast are trades executed?

We also know this as execution speed.

We defined execution speed as the amount of time between when the broker receives your order until execution.

The faster the speed, the more volume of trading that can occur.

The faster the speed, the more chances for a broker’s customers to buy or sell at the price that they have requested.

Ask the broker what their average execution speed is. Ideally, it should be 0.1 second (or 100 milliseconds) or less.

Also, ask what percentage of trades are executed in less than 1 second.

If orders are taking more than 1 second to execute, you’re most likely going to experience slippage because prices have changed before your order completes.

Prices in the forex market can move in milliseconds.

So if the broker’s execution speed is too slow, the price you clicked on to trade on may have changed by the time the broker can execute the order.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.