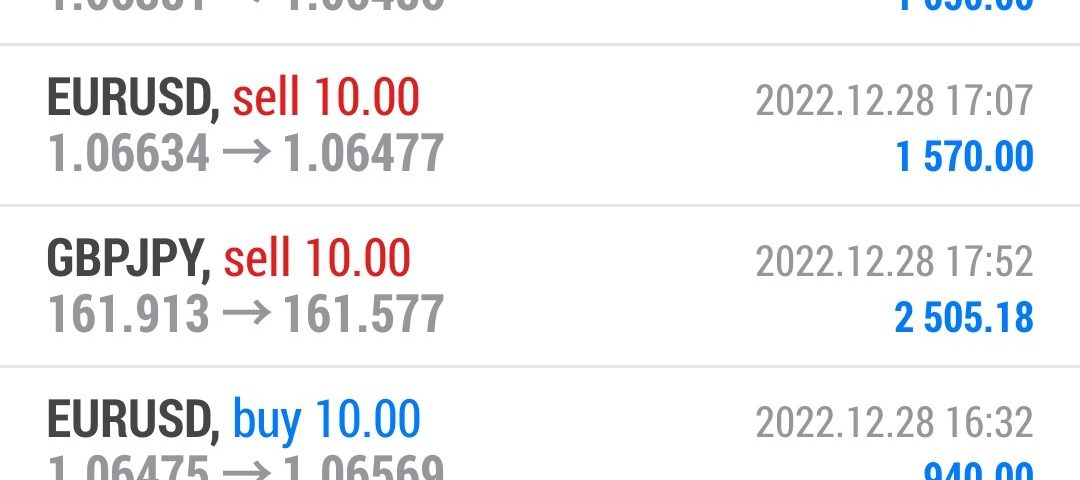

Forex Smart Trade Results, Wednesday, Dec. 28, 2022 – $8,085

Forex Smart Trade Results, Tuesday, Dec. 27, 2022 – $5,477

January 17, 2023

Forex Smart Trade Results, Thursday, Dec. 29, 2022 – $6,716

January 17, 2023What percentage of orders are executed with positive slippage?

What percentage of orders are executed with positive slippage?

Positive slippage, also known as price improvement, occurs when your order executes at a more favorable price than the price you request.

(The opposite of a price improvement is negative slippage, which is when your order executes at a less favorable price.)

Can the broker tell you the percentage of executed trades that were executed at a more favorable price than the price their customers requested?

And what is the average positive price improvement per order (in pips)?

This is defined by the pip difference between the requested and executed price of orders with the improved price.

Market and Limit Orders

Orders can also be further broken down by market and limit orders:

- What percentage of market orders are filled at a more favorable price than requested?

- What percentage of limit orders are filled at a more favorable price than requested?

For example, let’s say you want to buy EUR/USD immediately.

You hop on your forex broker’s trading platform, and see the price of 1.1050 being displayed and click “Buy”.

So 1.1050 is the price that you wanted your market order to be executed at.

The order is submitted, and you receive a confirmation that your buy order was filled at 1.1049 (1 pip below your requested price).

Because the order was filled at a better price (1.1049) than you requested (1.1050), you experienced positive slippage of 1 pip.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.