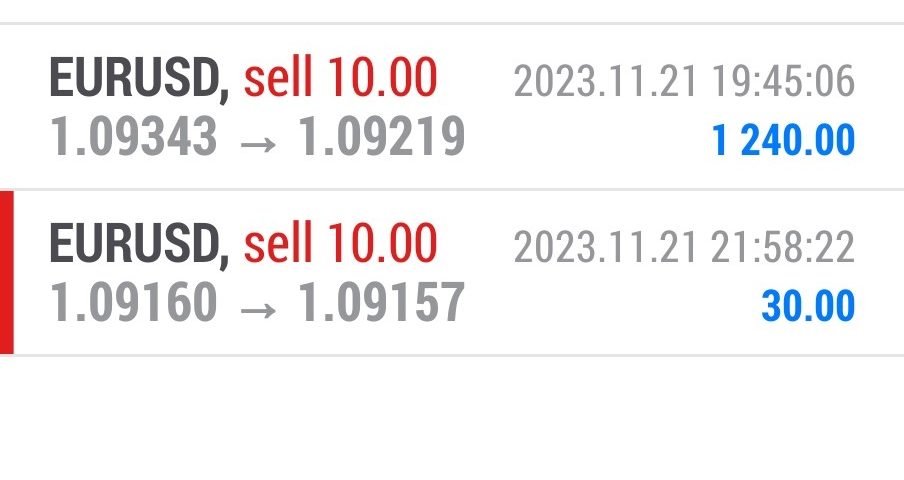

Forex Smart Trade Results, Tuesday, November 21, 2023 – $1,700

Forex Smart Trade Results, Monday, November 20, 2023 – $2,283

November 25, 2023

Forex Smart Trade Results, Wednesday, November 22, 2023 – $7,276

November 25, 2023ADX in a Ranging Market.

One way to determine if the market is ranging is to use the same ADX as discussed in the ADX lesson.

I say a market to be ranging when the ADX is below 25.

Remember, as the value of the ADX diminishes, the weaker trend is.

Bollinger Bands in a Ranging Market

In essence, Bollinger Bands contract when there is less volatility in the market and expand when there is more volatility.

Because of that, Bollinger Bands provide a good tool for breakout strategies.

When the bands are thin and contracted, volatility is low and there should be a little movement of price in one direction.

However, when bands start to expand, volatility is increasing and more movement of price in one direction is likely.

Generally, range trading environments will contain somewhat narrow bands compared to wide bands and form horizontally.

In this case, we can see that the Bollinger Bands are contracted, as the price is just moving within a tight range.

The basic idea of a range-bound strategy is that a currency pair has a high and low price that it normally trades between.

By buying near the low price, the forex trader is hoping to make a profit around the high price.

By selling near the high price, the trader is hoping to make a profit around the low price.

Popular tools to use are channels such as the one shown above and Bollinger Bands.

Using oscillators, like Stochastic or RSI, will help increase the odds of you finding a turning point in a range.

When this happens they can identify potentially oversold and overbought conditions.

Here’s an example using GBP/USD.

Bonus Tip

The best pairs for trading range-bound strategies are currency crosses.

By crosses, we mean those pairs that do not include the USD as one of the currencies in the pair.

One of the most well-known currency pairs for trading ranges is EUR/CHF.

The similar growth rates shared by the European Union and Switzerland pretty much keep the exchange rate of the EUR/CHF stable.

Another pair is AUD/NZD.

Conclusion

Whether you’re trading a pair that’s in a trending or ranging environment, you should take comfort in knowing that you can profit whatever the case may be.

Find out how you can pick tops and bottoms in both trending and ranging market environments.

By knowing what a trending environment and a range-bound environment are and what they look like, you’ll be able to employ a specific strategy for each.

As the old wise man in Central Park says, “Only a fool dips his cookies in habanero salsa!“

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.