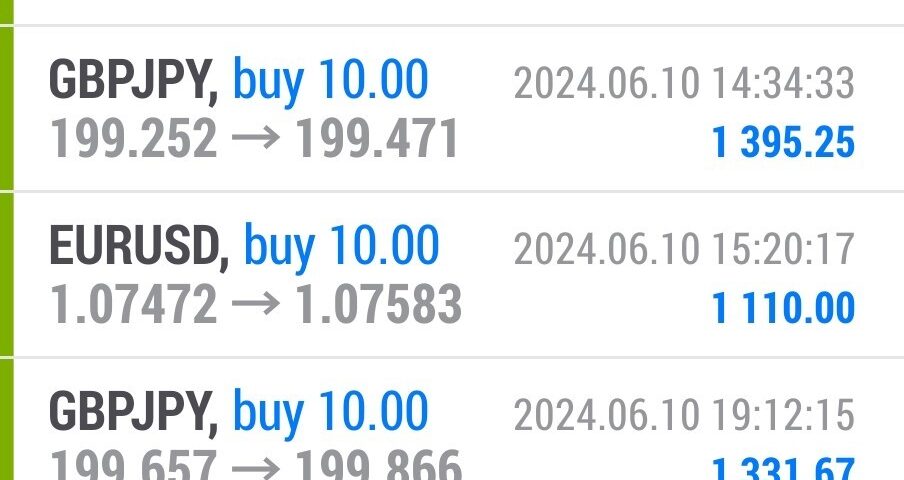

Forex Smart Trade Results, Monday, June 10, 2024 – $6,743

Forex Smart Trade Results, Friday, June 7, 2024 – $4,716

June 30, 2024

Forex Smart Trade Results, Tuesday, June 11, 2024 – $2,153

June 30, 2024What is the Dollar Smile Theory?

Stephen Jen, a former economist at the International Monetary Fund and Morgan Stanley, who now runs a hedge fund and advisory firm Eurizon SLJ Capital in London, came up with a theory and named it the “Dollar Smile Theory.”

The Dollar Smile Theory says the U.S. dollar tends to strengthen against other currencies when the U.S. economy is extremely strong OR weak.

The Dollar Smile Theory Explained

The Dollar Smile Theory is based on two assumptions:

- When the U.S. economy significantly outperforms the rest of the world, the U.S. dollar tends to be strong and increase in value relative to other currencies.

- When the global financial markets are disorderly or crashing, and sentiment switches to “risk-off“, since the U.S. dollar is perceived as the ultimate safe-haven currency, everyone rushes to safety and starts buying USD causing it to rally.

His theory depicts three main scenarios directing the behavior of the U.S. dollar.

Here’s a simple illustration:

Scenario #1: USD Strengthens Due to Risk Aversion

The first part of the smile shows the U.S. dollar benefiting from risk aversion, which causes investors to flee to “safe haven” currencies like the U.S. dollar and the Japanese yen.

The first part of the smile shows the U.S. dollar benefiting from risk aversion, which causes investors to flee to “safe haven” currencies like the U.S. dollar and the Japanese yen.

Since investors think that the global economic situation is shaky, they are hesitant to pursue risky assets and would rather buy up “safer” assets like U.S. government debt (“U.S. Treasuries”) regardless of the condition of the U.S. economy.

In order to buy U.S. Treasuries though, you need USD, so this increased demand for USD (to buy U.S. Treasuries) causes the U.S. dollar to strengthen.

Scenario #2: USD Weakens to New Low Due to Weak Economy

Dollar drops to a new low.

Dollar drops to a new low.

The bottom part of the smile reflects the lackluster performance of the Greenback as the U.S. economy grapples with weak economic fundamentals.

The possibility of interest rate cuts also weighs the U.S. dollar down. (Although if other countries are also expected to cut interest rates, then this might be less of a factor since it’s all about expectations of the future direction of interest rest differentials.)

This leads to the market shying away from the dollar. The motto for USD becomes “Sell! Sell! Sell!”

Another factor is the relative economic performance between the U.S. and other countries. The U.S. economy may not necessarily be horrible, but if its economic growth is weaker than other countries, then investors will prefer to sell their U.S. dollars and buy the currency of the country with the stronger economy.

It’s kind of like if you owned an NBA team and had Reggie Miller as your star player. All of a sudden, a healthy Michael Jordan is available. Obviously, you would trade Miller for Jordan because, on a relative basis, Jordan is the better performing player.

It’s not that Reggie Miller sucks, but there’s just a better alternative at that moment. Now if you make the trade, and all of a sudden, Michael Jordan has a season-ending injury, and Reggie Miller just so happens to be available, then you know what to do.

Dump “Air Jordan” for “Miller Time”. See, it’s all relative.

Learn How To Successfully Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.