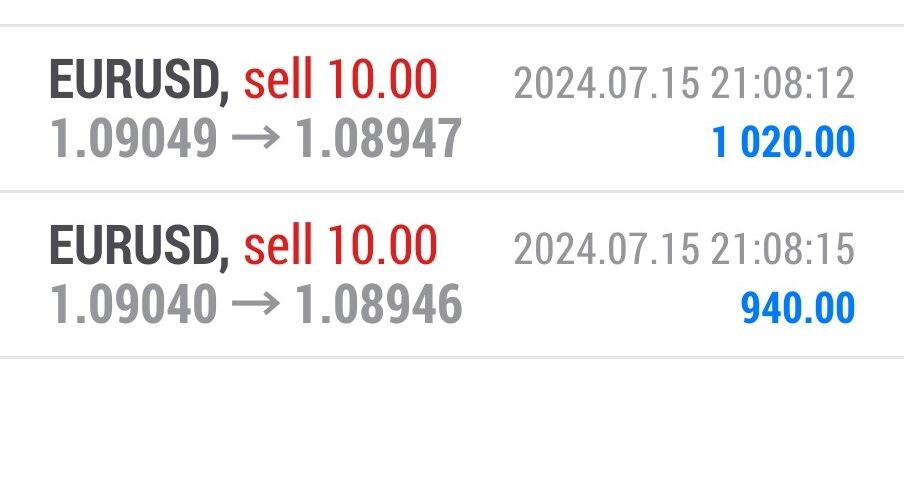

Forex Smart Trade Results, Monday, July 15, 2024 – (212)

Forex Smart Trade Results, Friday, July 12, 2024 – $2,083

July 29, 2024

Forex Smart Trade Results, Tuesday, July 16, 2024 – $4,497

July 29, 2024Important Economic Indicators for the euro.

Gross Domestic Product – Gross domestic product is the central measure of economic growth in the region. Since Germany is the largest economy in the eurozone, its GDP tends to move the euro the most.

Employment Change – The euro is also sensitive to changes in employment, particularly in the euro zone’s largest economies like Germany and France.

German Industrial Production – This measures the change in the volume of output from Germany’s manufacturing, mining, and quarrying industries. Because of this, it reflects the short-term strength of German industrial activity.

German IFO Business Climate Survey – This is one of the country’s key business surveys. Conducted monthly, this takes into account the current business situation of Germany as well as expectations for future conditions.

Budget Deficits – Recall that one of the criteria in the Maastricht Treaty requires that eurozone economies keep their debt-to-GDP ratio below 60% and their deficit less than 3% of their annual GDP.

Failure to achieve these targets could result in fiscal instability in the eurozone.

Consumer Price Index – Since one of the goals of the ECB is to maintain price stability, they keep an eye on inflation indicators such as the CPI.

If the annual CPI deviates from the central bank target, the ECB could make use of its monetary policy tools to keep inflation in check.

What Moves the EUR?

Eurozone Fundamentals

Reports of strong economic performance by the eurozone as a whole, or by its member nations, can boost the euro higher.

For instance, better than expected GDP reports from Germany or France could encourage traders to be bullish on the euro.

Uncle Sam’s Groovy Moves

Sudden changes in market sentiment, buoyed mostly by U.S. economic data, tend to have a huge impact on EUR/USD.

Being considered the anti-dollar, the euro is also swayed by talks of reserve diversification away from the U.S. dollar.

Euro as the new reserve currency, anyone?

Differences in Rates of Return

The bond spread between 10-year U.S. government bonds and 10-year Bunds (German bonds) usually indicate the direction of EUR/USD.

If the difference between the yields of the U.S. bonds and Bunds widens, EUR/USD moves in favor of the currency with the higher yield.

Similar to bond yields, interest rate differentials also serve as an excellent indicator of the EUR/USD movement.

For instance, traders usually compare the Euribor futures rate with the Eurodollar futures rate.

Just to clear things up: “Euribor” is an acronym that stands for Euro interbank offer rate, which is the rate Euro zone banks use for inter-bank transactions, while Eurodollars are deposits denominated in U.S. dollars.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.