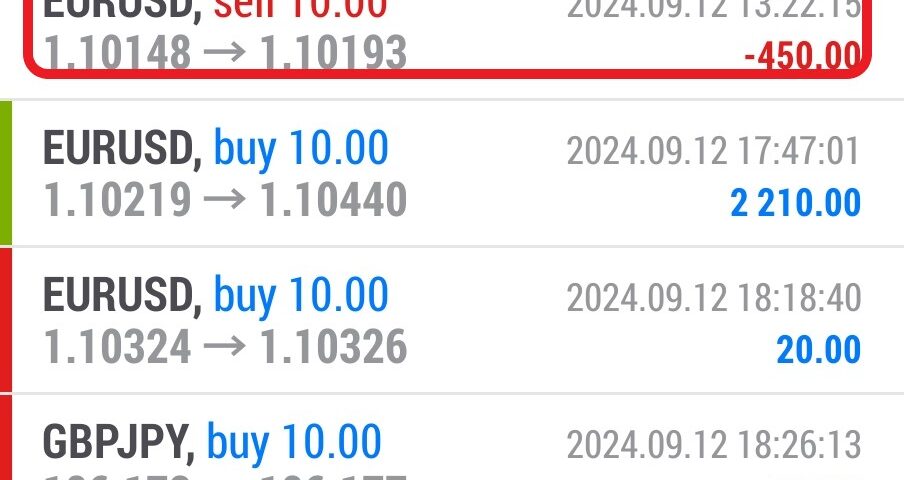

Forex Smart Trade Results, Thursday, September 12, 2024 – $9,655

Forex Smart Trade Results, Wednesday, September 11, 2024 – $6,569

October 14, 2024

Forex Smart Trade Results, Friday, September 13, 2024 – $7,079

October 14, 2024China: Important Economic Indicators for the CNY.

GDP – This figure acts as China’s economic report card because it reflects how much their economy expanded or contracted for the period.

This is typically reported on a quarterly basis compared to the same quarter in the previous year.

CPI – The PBoC keeps a close eye on the Chinese CPI report because it reflects how much price levels have changed over a particular period of time.

If the annual CPI reading exceeds or falls below the Chinese government’s target levels, the PBoC could wield its monetary policy tools in its next rate decision.

Trade Balance – A huge chunk of China’s economy is comprised of international trade, which means that the trade balance is typically considered a leading indicator of growth.

PBoC Interest Rate Decision – As we mentioned earlier, PBoC is notorious for making aggressive monetary policy changes whenever they feel that the Chinese economy is overheating or if it needs more stimulus.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.