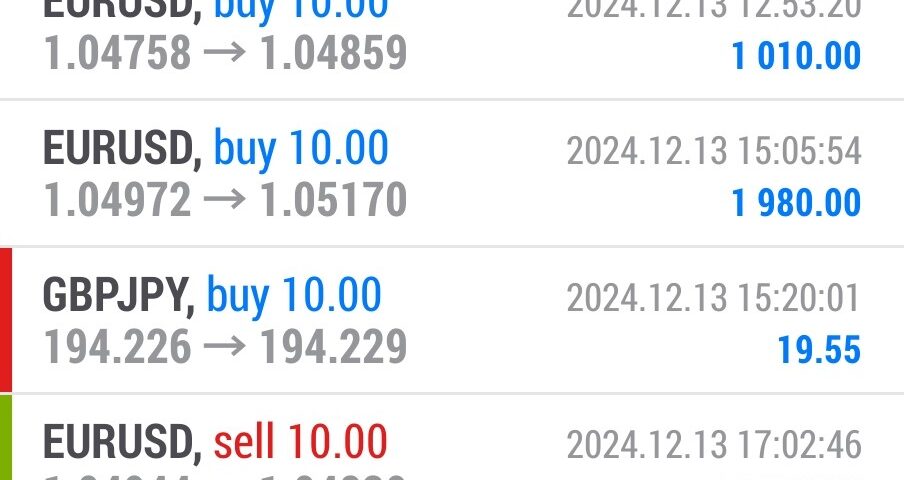

Forex Smart Trade Results, Fri., Dec. 13, 2024 – $6,280

Forex Smart Trade Results, Thur., Dec. 12, 2024 – $806

December 25, 2024

Forex Smart Trade Results, Mon., Dec. 16, 2024 – $9,398

December 25, 2024Types of Swing Trading.

How do you swing trade?

There are several different trading strategies often used by swing traders.

Here are the four most popular: reversal, retracement (or pullback), breakouts, and breakdowns.

Reversal Trading

Reversal trading relies on a change in price momentum. A reversal is a change in the trend direction of an asset’s price.

For example, when an upward trend loses momentum and the price starts to move downwards. A reversal can be positive or negative (or bullish or bearish).

Retracement Trading

Retracement (or pullback) trading involves looking for a price to temporarily reverse within a larger trend.

Price temporarily retraces to an earlier price point and then continues to move in the same direction later.

Reversals are sometimes hard to predict and to tell apart from short-term pullbacks.

While a reversal denotes a change in trend, a pullback is a shorter-term “mini reversal” within an existing trend.

Think of a retracement (or pullback) as a “minor countertrend within the major trend”.

If it’s a retracement, price moving in against the primary trend should be temporary and relatively brief.

Reversals always start as potential pullbacks.

The challenge is to know whether it is only a pullback or an actual trend reversal

Breakout Trading

Breakout trading is an approach where you take a position on the early side of an UPTREND, and looking for the price to“breakout”.

You enter into a position as soon as price breaks a key level of RESISTANCE.

Breakdown Strategy

A breakdown strategy is the opposite of a breakout strategy.

You take a position on the early side of a DOWNTREND and looking for price to “breakdown” (also known as a downside breakout).

You enter into a position as soon as price breaks a key level of SUPPORT.

You might want to be a swing trader if:

- You don’t mind holding your trades for several days.

- You are willing to take fewer trades but more careful to make sure your trades are very good setups.

- You don’t mind having large stop losses.

- You are patient.

- You are able to remain calm when trades move against you.

You might NOT want to be a swing trader if:

- You like fast-paced, action-packed trading.

- You are impatient and like to know whether you are right or wrong immediately.

- You get sweaty and anxious when trades go against you.

- You can’t spend a couple of hours every day analyzing the markets.

- You can’t give up your World of Warcraft raiding sessions.

If you have a full-time job but enjoy trading on the side, then swing trading might be more your style!

It is important to remember that every trading style has its pros and cons, and it is up to you the trader, which one you will choose.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 30-day trial so you can assess the value of our indicators and tools for yourself.