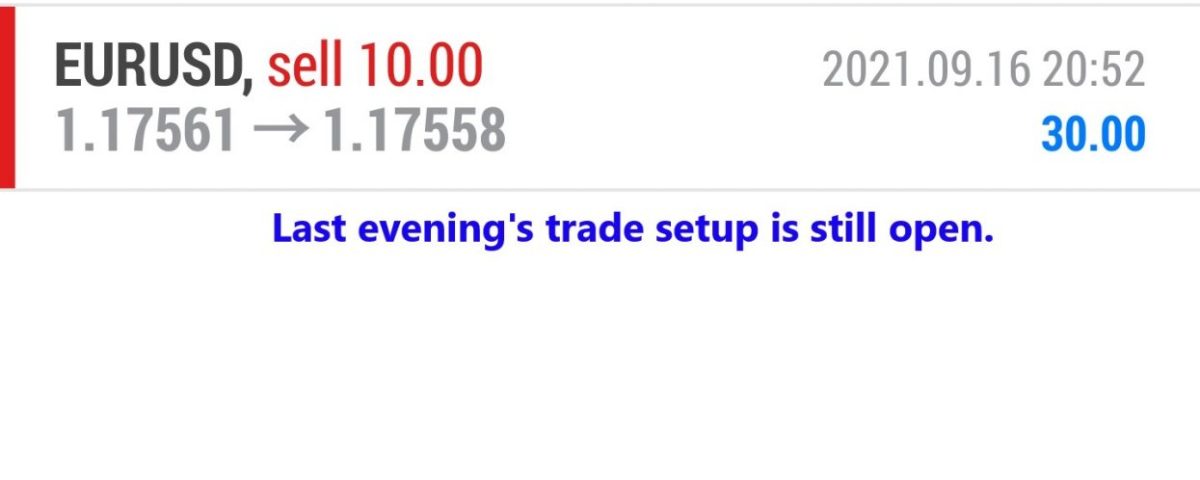

Forex Trade Results September 16, 2021

Forex Trade Results September 15, 2021

September 15, 2021

Forex Trade Results September 17, 2021

September 17, 2021Learn to Trade Forex: Major Announcements

Want to learn to forex trade? Then you need to understand how central bank major announcements impact the currency market. You also need great trading tools, so check out Forex Smart Trade.

The Central bank is an essential party to move the exchange rates. The major announcements from the eight central banks can increase or decrease the exchange rates. But the banks are often considered as less impactful than economic indicators. Whenever the board of directors makes a public statement, they usually provide information on how the bank looks at inflation.

For example, Federal Reserve Chair Ben Bernanke gave his semi-annual monetary policy testimony before the House Committee on July 16, 2008. But in a normal session, he would read the prepared statement and answer the asked questions.

In his statement, Bernanke stated that the U.S. dollar is doing well in the market, and the government was stabilizing it. But simultaneously, there were concerns all over the market.

However, the traders welcomed the statement, and they anticipated the rise in interest rates by Federal Reserve. This uplifts the demand for the dollar in the market.

The EUR/USD declined 44 points over one hour (good for the U.S. dollar), which made $440 profit for traders who positively responded to the announcement.

Learn How To Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar that shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 30-day introductory trial for just ONE dollar.