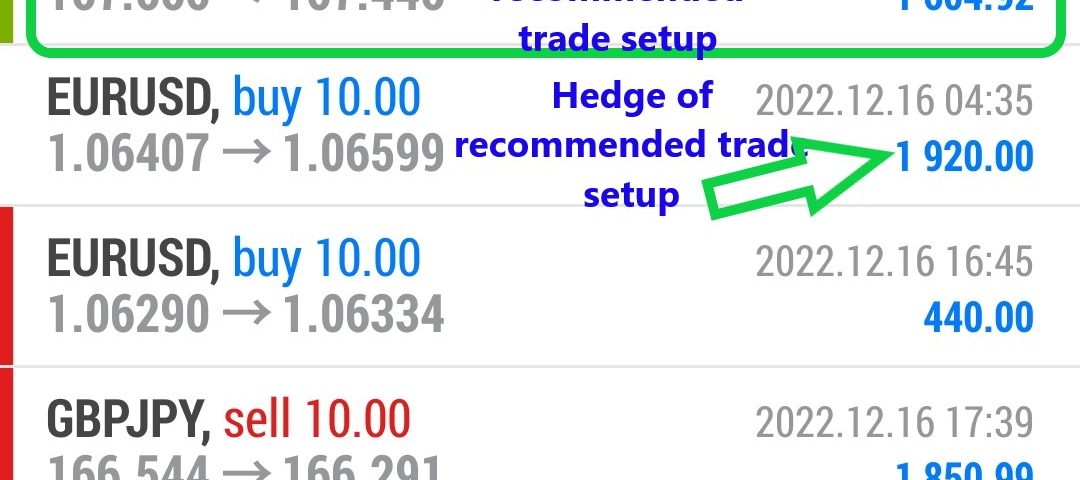

Forex Smart Trade Results Friday, Dec. 16, 2022 – $9,006

Forex Smart Trade Results Thursday, Dec. 15, 2022 – $4,857

December 17, 2022

Forex Smart Trade Results Monday, Dec. 19, 2022 – $3,337

January 9, 2023What percentage of orders are executed with slippage?

What percentage of orders are executed with slippage?

When you see a price on your broker’s trading platform and want to trade on that price, your broker is supposed to exert every effort to fill your order at that requested price.

When executing orders, the broker has an obligation to take ALL sufficient steps to obtain the best possible result for their customers, considering multiple factors.

We know this as striving for “best execution“.

Ideally, getting the “best possible result” means you get the price that you requested.

But while the price is the most important factor when considering the best execution, it’s not the ONLY factor.

This means that the price you wanted may not be the price they execute your order at.

Whenever you are filled at a price different from the price requested, it’s called “slippage“.

Spreads

Traders typically focus more on the spread, while largely ignoring slippage unless the slippage is blatantly obvious when one of their orders is filled

Slippage isn’t necessarily something that’s bad.

ANY difference between the intended execution price and the actual execution price qualifies as slippage.

Market prices can change quickly.

When this happens slippage occurs during the delay between a trade order being processed and when it is completed.

Slippage can occur for many reasons, but price volatility is often the biggest reason.

As price volatility increases, slippage (both positive and negative) occurs more frequently.

As price volatility decreases, slippage occurs less frequently.

This is why traders typically see more slippage during high periods of volatility, such as during breaking news or economic data releases.

Under normal market conditions, if your broker cares about execution quality, occurrences of slippage should be infrequent and the magnitude of slippage should be minimal.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.