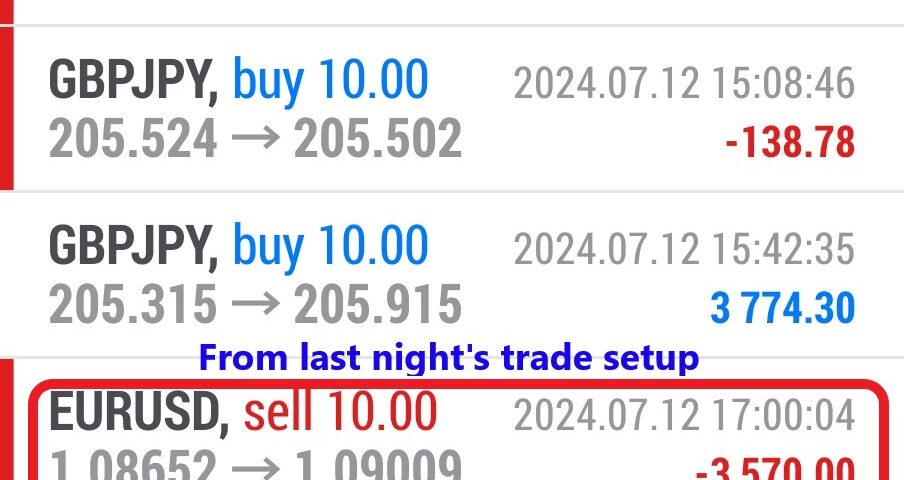

Forex Smart Trade Results, Friday, July 12, 2024 – $2,083

Forex Smart Trade Results, Thursday, July 11, 2024 – $543

July 17, 2024

Forex Smart Trade Results, Monday, July 15, 2024 – (212)

July 29, 2024Monetary & Fiscal Policy.

The European Central Bank (ECB) acts as the governing body for the monetary policy of the EU.

Led by the current ECB President Christine Lagarde, the Executive Board also consists of the ECB Vice President and four other policymakers.

Along with the top guns from the national central banks within the eurozone, they make up the ECB Governing Council who votes on monetary policy changes.

Main Objective

The main objective of the ECB is to maintain price stability in the entire region – quite a tall order!

To achieve this goal, the eurozone signed the Maastricht Treaty which applied a certain set of criteria for the member nations.

Requirements

Here are some of the requirements:

- The nation’s inflation rate must not exceed the average inflation of the three best performing (lowest inflation rates) states by more than 1.5%.

- Their long-term interest rates must not exceed the average rates of these low-inflation states by more than 2%.

- Exchange rates must stay within the range of the exchange rate mechanism for at least a couple of years.

- Their government deficit must be less than 3% of their GDP.

If a nation fails to meet these conditions, it is penalized with a hefty fine. Yikes!

The ECB also makes use of its minimum bid rate and open market operations as its monetary policy tools.

The ECB minimum bid rate or repo rate is the rate of return the central bank offers to the central banks of its member states.

They make use of this rate to control inflation.

Open market operations, on the other hand, are used to manage interest rates, control liquidity, and establish a monetary policy stance.

Such operations are conducted through buying or selling of government securities in the market.

In order to increase liquidity, the ECB buys securities and pays with euros, which then gets circulated.

Conversely, to mop up excess liquidity, the ECB sells securities in exchange for euros.

Other than making use of those monetary policy tools, the ECB can also opt to intervene in the foreign exchange market to further cap inflation.

Because of this, traders pay close attention to comments from the Governing Council members since these could impact the EUR.

Getting to Know the euro

Aside from being dubbed the anti-dollar, the euro is also nicknamed “fiber.”

Some say that this nickname was derived from the Trans-Atlantic fiber optic, which was used for communication, while some argue that it was from the paper used to print European banknotes way back then! Here are some of the other characteristics of the euro.

Here are some of the other characteristics of the euro.

They call me the Anti-Dollar!

With the euro popularly known as the anti-dollar, EUR/USD is the most actively traded currency pair. As such, it is also the most liquid of the major pairs and offers the lowest pip spread.

I’m busy during the London session…

The euro is most active during 8:00 am GMT, at the beginning of the London session. It often has little movement during the latter half of the U.S. session, around 5:00 pm GMT.

…and I’ve had a few relationships.

EUR/USD is often linked to the movement of capital markets, such as bonds and equities. It is negatively correlated to the movement of the S&P 500, which represents the performance of the U.S. stock market.

This correlation was thrown out of sync after the 2007 financial crisis though. Now, EUR/USD has a slightly positive correlation with the S&P 500.

EUR/USD is also negatively correlated to USD/CHF, reflecting how the Swiss Franc moves in almost perfect tandem with the euro.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.