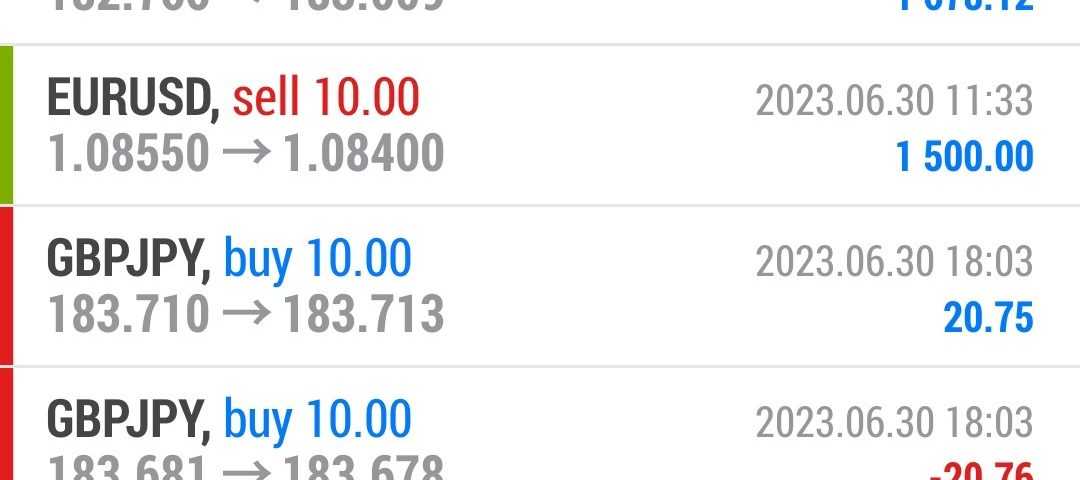

Forex Smart Trade Results, Friday, June 30, 2023 – $5,069

Forex Smart Trade Results, Thursday, June 29, 2023 – $8,483

July 24, 2023

Forex Smart Trade Results, Monday, July 3, 2023 – $5,722

July 24, 2023How to Trade Using Ichimoku Kinko Hyo.

Senkou

Let’s take a look at the Senkou span first.

If the price is above the Senkou span, the top line serves as the first support level while the bottom line serves as the second support level.

If the price is below the Senkou span, the bottom line forms the first resistance level while the top line is the second resistance level. Got it?

Kijun Sen

Meanwhile, the Kijun Sen acts as an indicator of future price movement.

If the price is higher than the blue line, it could continue to climb higher.

If the price is below the blue line, it could keep dropping.

Tenkan Sen

The Tenkan Sen is an indicator of the market trend.

If the red line is moving up or down, it indicates that the market is trending.

If it moves horizontally, it signals that the market is ranging.

Chikou Span

Lastly, if the Chikou Span or the green line crosses the price in the bottom-up direction, that’s a buy signal.

If the green line crosses the price from the top down, that’s a sell signal.

Here’s that line-filled chart once more, this time with the trade signals:

It sure looks complicated at first but this baby’s got support and resistance levels, crossovers, oscillators, and trend indicators all in one go! Amazing, right?

As a trend-following indicator, Ichimoku can be used in any market, in any timeframe.

Regardless of the market, Ichimoku emphasizes trading in the direction of the trend and NOT against the trend.

By following trends, Ichimoku can help you to avoid entering the wrong side of where the market.

Learn to Day Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.