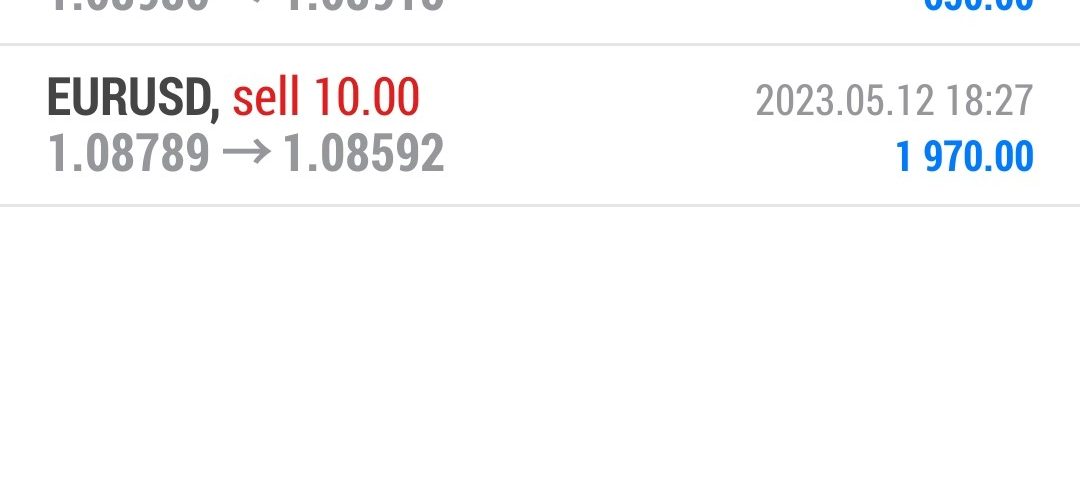

Forex Smart Trade Results, Friday, May 12, 2023 – $4,590

Forex Smart Trade Results, Thursday, May 11, 2023 – $6,776

May 21, 2023

Forex Smart Trade Results, Monday, May 15, 2023 – $6,989

May 21, 2023How to Trade Currencies with the Guppy Multiple Moving Average.

Let’s examine how to trade currencies with the Guppy multiple moving average.

The GMMA indicator can be used for trade signals.

Buy Signals

When all short-term EMA cross above all the long-term EMAs, a new bullish trend is confirmed and triggers a buy signal.

During a strong uptrend, when the short-term MAs move back toward the longer-term MAs, but do NOT cross, and then start to move back higher, this signals another continuation of the bullish trend and triggers a buy signal.

Also, after a crossover, if prices fall back and then bounce off from the longer-term EMAs, this signals a continuation of the bullish trend and triggers a buy signal.

Sell Signals

When all short-term EMAs cross below all the long-term EMA, this indicates a new bearish trend and triggers a sell signal.

During a strong downtrend, when the short-term MAs move back toward the longer-term MAs, but do NOT cross, and then start to move lower, this signals a continuation of the bearish trend and triggers a sell signal.

Also, after a bearish crossover, if the price rises but then bounces off from the long-term EMAs, this signals a continuation of the bearish trend and triggers a sell signal.

No Signal

We should avoid the buy and sell signals above when the price and the EMAs are moving sideways.

Following a consolidation period, wait for a crossover and separation.

If there is no trend, this indicator will not work.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.