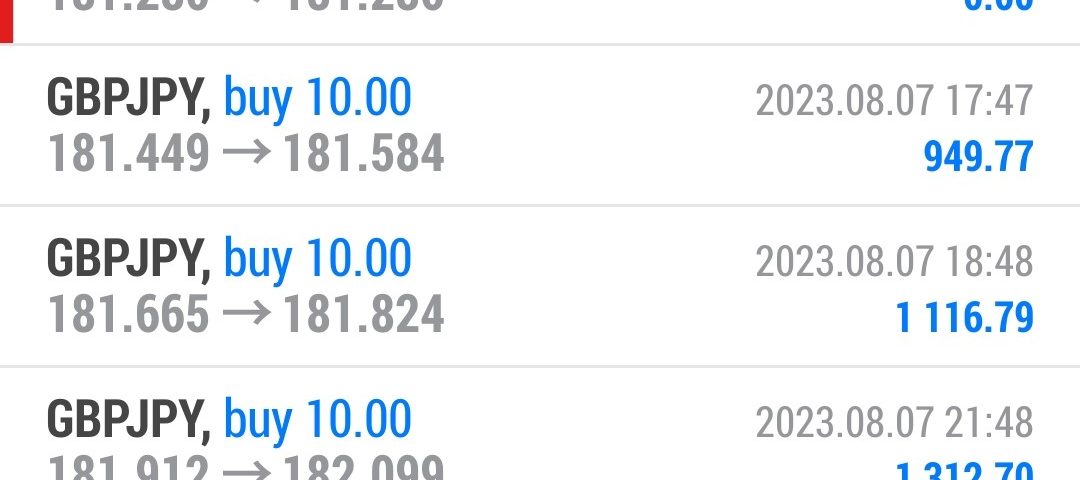

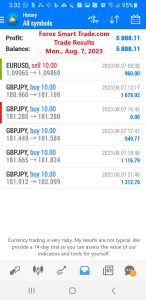

Forex Smart Trade Results, Monday, August 7, 2023 – $5,888

Forex Smart Trade Results, Friday, August 4, 2023 – $5,607

August 26, 2023

Forex Smart Trade Results, Tuesday, August 8, 2023 – $4,101

August 27, 2023Bearish Rectangle.

A bearish rectangle is formed when the price consolidates for a while during a downtrend.

This happens because sellers probably need to pause and catch their breath before taking the pair any lower.

In this example, the price broke the bottom of the rectangle chart pattern and continued to shoot down.

If we had a short order just below the support level, we would have made a nice profit on this trade.

Here’s a tip: Once the pair falls below the support, it tends to make a move that is about the size of the rectangle pattern.

In the example above, the pair moved beyond the target so there would have been a chance to catch more pips!

Bullish Rectangle

Here’s another example of a rectangle, this time, a bullish rectangle chart pattern.

After an uptrend, the price paused to consolidate for a bit. Can you guess where the price is headed next?

If you answered up, then you’re right! Check out that nice upside breakout right there!

Notice how the price moved all the way up after breaking above the top of the rectangle pattern.

If we had a long order on top of the resistance level, we would’ve caught some pips on the trade!

Just like in the bearish rectangle pattern example, once the pair breaks, it will usually make a move that’s AT LEAST the size of its previous range.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.