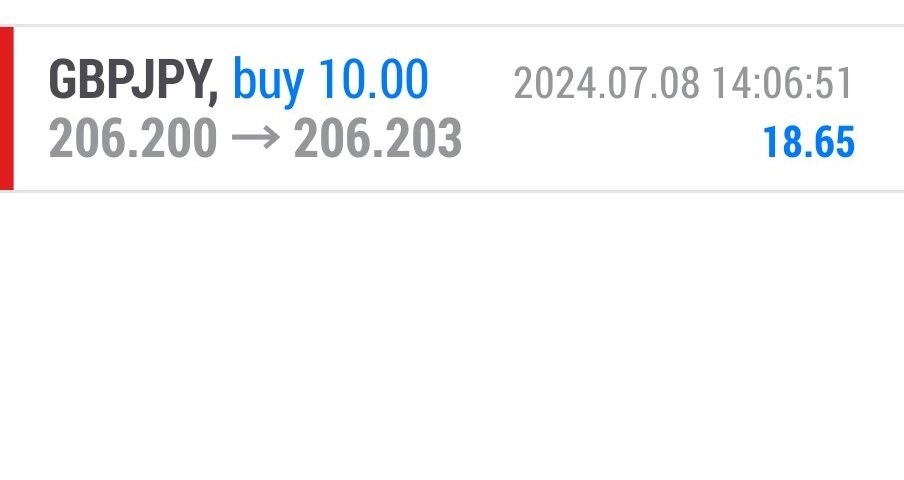

Forex Smart Trade Results, Monday, July 8, 2024 – $85

Forex Smart Trade Results, Friday, July 5, 2024 – $1,473

July 16, 2024

Forex Smart Trade Results, Tuesday, July 9, 2024 – ($82)

July 17, 2024Trading the USD.

USD as the Base Currency

USD/XXX is traded in amounts denominated in USD. Standard lot sizes are 100,000 USD and mini lot sizes are 10,000 USD.

The pip value per unit traded, which is denominated in XXX currency, is calculated by dividing 1 pip of the USD/XXX, (that’s 0.0001 or 0.01 depending on the pair), by the USD/XXX’s current exchange rate.

Profit and loss are denominated in XXX.

For example, if one pip is equal to 0.0001 and the current exchange rate of USD/XXX is 1.4000, one pip would equal $0.000071 USD.

For one standard lot position size (100,000 units), each pip movement is worth $7.142857 USD.

For one mini lot position size (10,000 units), each pip movement is worth $0.714286.

Margin calculations are based in US dollars. With leverage of 100:1, 1,000 USD is needed to trade 100,000 USD/CAD.

USD as the Quote Currency

XXX/USD is traded in amounts denominated in XXX. Standard lot sizes are 100,000 XXX and mini lot sizes are 10,000 XXX.

The pip value, which is denominated in US dollars, is calculated by dividing 1 pip of the XXX/USD (that’s 0.0001 or 0.01 depending on the pair) by XXX/USD’s current exchange rate.

Profit and loss are denominated in U.S. dollars.

For one standard lot position size (100,000 units), each pip movement is worth $10 USD.

For one mini lot position size (10,000 units), each pip movement is worth $1 USD.

So for example, if the EUR/USD exchange rate changed from 1.0611 to 1.0616, and we have a one standard lot position, that 5 pip move (1.0616 – 1.0611) would equal $50 USD (5 pip move X $10 USD per pip).

Margin calculations are based in US dollars.

For example, if the current XXX/USD rate is 0.8900 and the leverage is 100:1, 890 USD is needed in available margin to be able to trade on a standard lot of 100,000 XXX.

However, as the XXX/USD rate increases, a larger available margin in USD is required.

Conversely, the lower the XXX/USD rate is, the less required available margin is needed.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.