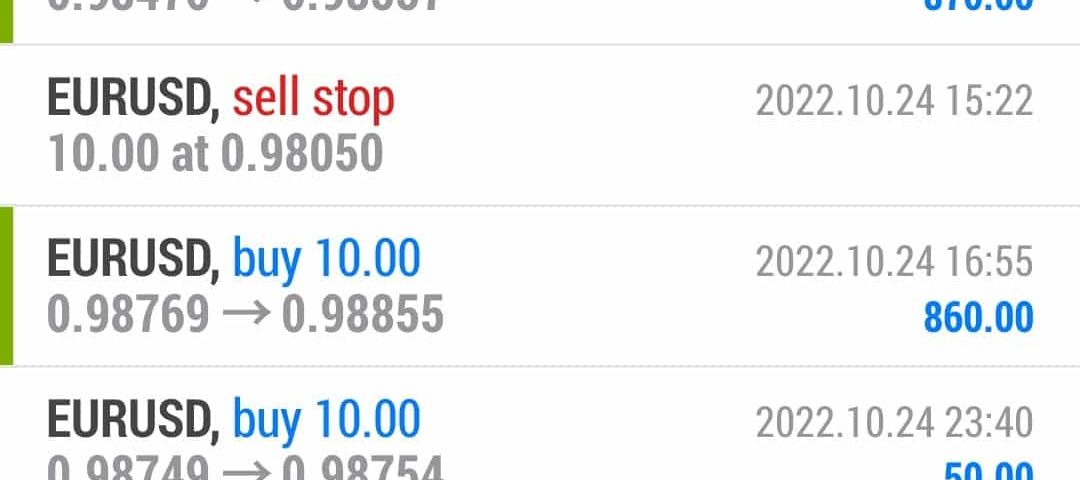

Forex Smart Trade Results October 24, 2022 – $4,290

Forex Smart Trade Results October 21, 2022 – $2,732

October 25, 2022

Forex Smart Trade Results October 25, 2022 – $5,059

October 25, 2022How Does an A-Book Broker Make Money?

Let’s take a look at an example of how does an A-Book broker make money.

Price Markup Example: Buy EUR/USD

In this example, the broker adds a price markup of 0.0001 or 1 pip.

Elsa opens a long EUR/USD position at 1.2001.

Her position size is 3,000,000 units or 30 standard lots. This means a 1-pip move equals $300.

Notice how the broker buys lower from the LP than it sells to Elsa.

It bought EUR/USD at 1.2000 from the LP but sold EUR/USD to Elsa at 1.2001.

This is the 1-pip price markup in action.

When Elsa exits her trade, a price markup also occurs.

Notice how the broker sells higher to the LP than it buys from Elsa.

The LP is willing to buy EUR/USD at 1.2100, so the broker quotes Elsa 1.2099, to ensure it makes a profit on the transaction.

Scenario #1: EUR/USD Rises

As you can see, EUR/USD ended up rising.

Elsa ended up with a profit of 98 pips, which means her counterparty, the broker, ended up with an equivalent loss.

But…the broker was also in a separate trade with an LP.

In this trade, the broker ended up with a profit of 100 pips, which means its counterparty, the LP, ended up with a loss of 100 pips.

The profit made from its trade with the LP exceeds the loss incurred from its trade with Elsa (due to price markup), so the broker made an overall net profit of 2 pips or $600 ($300 x 2 pips).

Notice how when Elsa “won” here, the broker did not “lose”.

Because the broker had transferred the market risk to the LP, it avoided a loss when Elsa’s trade won.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.