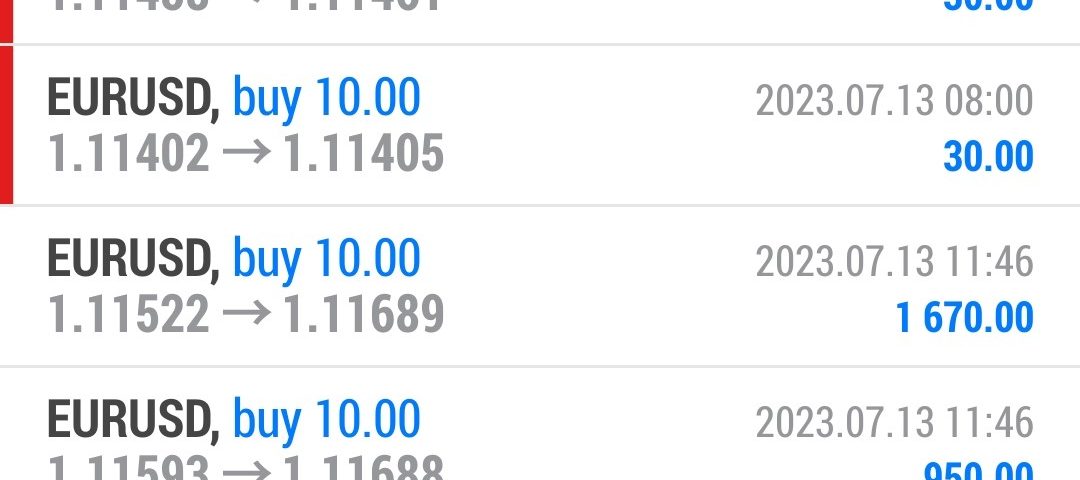

Forex Smart Trade Results, Thursday, July 13, 2023 – $8,966

Forex Smart Trade Results, Wednesday, July 12, 2023 – $20,562

July 31, 2023

Forex Smart Trade Results, Friday, July 14, 2023 – $2,726

July 31, 2023Leading and Lagging Indicators.

Let’s continue our discussion on leading and lagging indicators.

You would “catch” the entire trend every single time IF the leading indicator was correct every single time.

But it won’t be.

Fake Outs

When you use leading indicators, you will experience a lot of fake outs.

Leading indicators are notorious for giving bogus signals which could “mislead” you.

Get it? Leading indicators that “mislead” you?

The other option is to use lagging indicators, which aren’t as prone to bogus signals.

Lagging indicators only give signals after the price change is clearly forming a trend.

Late Entering

The downside is that you’d be a little late in entering a position.

Often the biggest gains of a trend occur in the first few bars, so by using a lagging indicator, you could potentially miss out on much of the profit.

And that sucks.

It’s kinda like wearing bell bottoms in the 1980s and thinking you’re so cool and hip with fashion…

Or like discovering Facebook for the first time when all your friends are already on TikTok…

Or like getting excited about buying a new flip phone that now takes photos when the iPhone 11 Pro came out…

Lagging indicators have you buy and sell late.

But in exchange for missing any early opportunities, they greatly reduce your risk by keeping you on the right side of the market.

For this lesson, let’s broadly categorize all of our technical indicators into one of two categories:

- Leading indicators or oscillators

- Lagging or trend-following indicators

While the two can be supportive of each other, they’re more likely to conflict with each other.

Sideways Markets

Lagging indicators don’t work well in sideways markets.

Do you know what does though? Leading indicators!

Yup, leading indicators perform best in sideways, “ranging” markets.

The general approach is that you should use lagging indicators during trending markets and leading indicators during sideways markets.

We’re not saying that one or the other should be used exclusively, but you must understand the potential pitfalls of each.

Learn to Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.