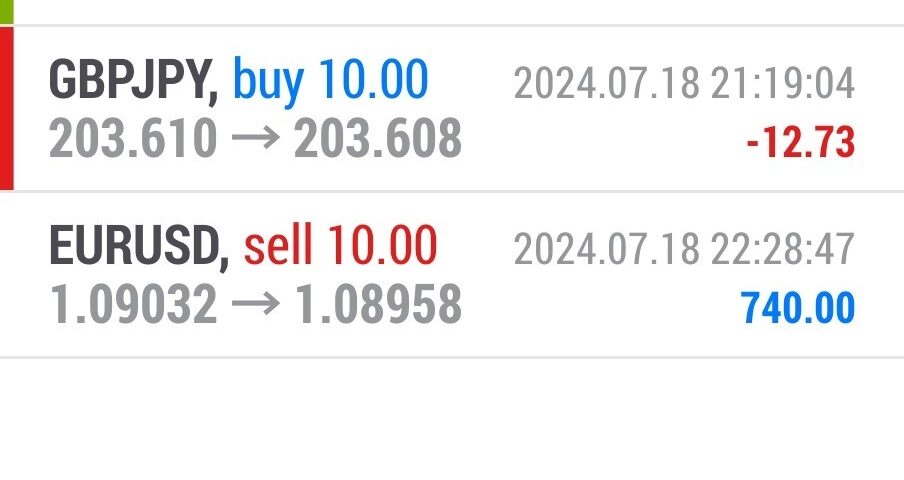

Forex Smart Trade Results, Thursday, July 18, 2024 – $2,370

Forex Smart Trade Results, Wednesday, July 17, 2024 – $1,202

July 29, 2024

Forex Smart Trade Results, Friday, July 19, 2024 – $3,929

August 6, 2024United Kingdom – Monetary & Fiscal Policy.

Now here’s a little bit of trivia for all of you: The oldest central bank in the world is the Bank of England (BOE).

Back in the day, when England was on the verge of economic expansion, government leaders realized that they needed an entity to help facilitate international trade.

Enter the Bank of England. In 1694, the BOE was founded to help facilitate trade and growth for England.

Today, the BOE’s main monetary policy objective is that of maintaining price stability while at the same time, fostering growth and employment.

As it is, the BOE is aiming for a target inflation rate of 2.0%, which is measured by the consumer price index (CPI).

In order to meet this target, the BOE has been granted the magical power to change interest rates to levels that they believe will allow them to meet this target.

Monetary Policy Committee

The group within the BOE that is in charge of determining interest rates is the Monetary Policy Committee (MPC).

The MPC holds monthly meetings, which are closely followed for announcements on changes in monetary policy, including changes in the interest rate.

Like all other things British, interest rates have a different name in England. In England, the interest rate is called the bank repo rate.

The main policy tools used by the BOE’s Monetary Policy Committee are bank repo rate and open market operations.

Bank Repo Rate

The bank repo rate is the rate set by the BOE for its own operations in the market to help meet the MPC’s inflation target.

Whenever the MPC changes this rate, it affects the rates of commercial banks set for their savers and borrowers.

This, in turn, will also affect spending and output in the economy, and eventually costs and prices.

Like other central banks, if the BOE raises the repo rate, they are aiming to curb inflation.

On the other hand, if they lower the rate, they are aiming to stimulate growth in the economy.

When the BOE engages in open market operations, the BOE buys and sells GBP denominated treasuries and securities to control the supply of money.

This is an alternative method to increase liquidity in the financial markets.

If the BOE feels that there is a need to stimulate the economy, they will “print more money” and inject this into the money supply through the purchases of the government and corporate securities.

On the other hand, if the BOE feels like the economy has had enough candy, they will sell more securities, effectively “taking back” money from the economy.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.