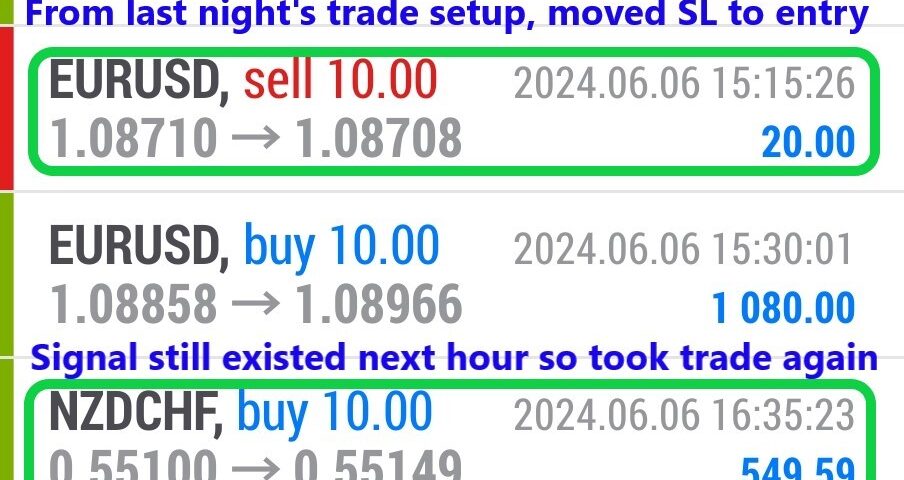

Forex Smart Trade Results, Thursday, June 6, 2024 – $644

Forex Smart Trade Results, Wednesday, June 5, 2024 – $4,864

June 30, 2024

Forex Smart Trade Results, Friday, June 7, 2024 – $4,716

June 30, 2024Which Currencies Are Part of the Bloomberg Dollar Spot Index?

Here is the most recent composition of the Bloomberg Dollar Spot Index compared to the previous year.

How the Bloomberg Dollar Spot Index Determines Which Currencies to Include

The index rebalances once a year to incorporate new data from:

- The annual survey of major trading partners versus the U.S. dollar as reported by the Federal Reserve.

- The triennial survey of most liquid currencies as reported by the Bank of International Settlements (BIS).

Currencies pegged to the U.S. dollar are excluded and currencies heavily managed (like the Chinese renminbi) have their exposure capped.

To ensure tradability, currencies with weights of less than 2% are removed.

At each annual rebalance, the following steps are taken to select which currencies to include and their weights:

- Identify the top 20 currencies in terms of trading activity versus the underlying currency. For the U.S. dollar, this is as defined by the Federal Reserve in its Broad Index of the Foreign Exchange Value of the Dollar.

- Identify the top 20 currencies from the Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity.

- Specific information about foreign exchange turnover can be found here.

- Select the top 10 currencies of both lists, but exclude any pegged currencies. For example, currencies pegged to the U.S. dollar (such as the Hong Kong dollar or Saudi riyal) are removed for the Bloomberg Dollar Spot Index.

- Assign a preliminary weight for each currency based on its trade weight and liquidity weight.

- Cap the exposure of Chinese renminbi and remove smaller currency positions, defined as any position that has a weight of less than 2%.

- Voila! BBDXY calculation complete!

The rebalanced target weights are applied after the close of the last U.S trading day in December every year.

Here’s a chart that visualizes the above process:

How to View the Bloomberg Dollar Spot Index

For Bloomberg subscribers, you can run BDXY on the Bloomberg Terminal® to view the Bloomberg Dollar Spot Index.

But if you can’t afford to pay the $20,000 annual fee for a Bloomberg Terminal subscription, you can access the live BBDXY quote for free on Bloomberg’s website.

On Bloomberg’s BBDXY page, you’ll see a live quote that looks like this:

You can even view a full chart by clicking near the top right corner.

You can also access the DXY quote on Bloomberg’s website as well.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.