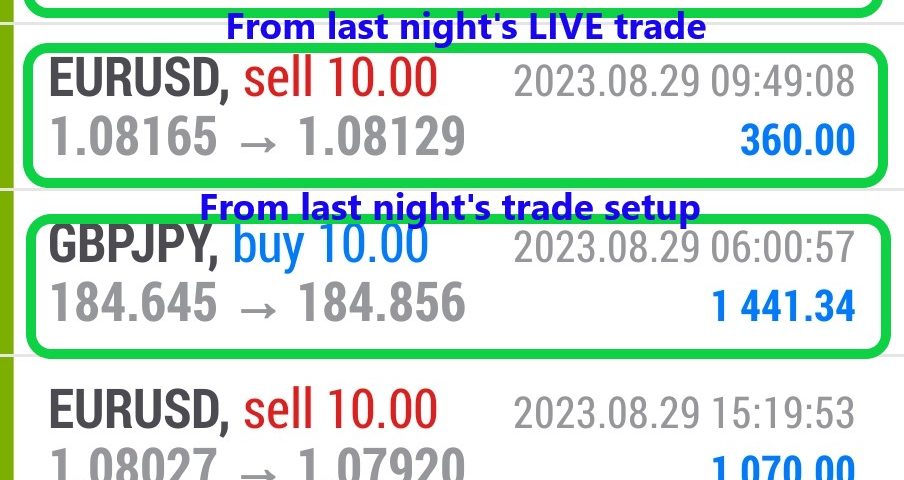

Forex Smart Trade Results, Tuesday, August 29, 2023 – $10,913

Forex Smart Trade Results, Monday, August 28, 2023 – $1,524

September 4, 2023

Forex Smart Trade Results, Wednesday, August 30, 2023 – $8,737

September 4, 2023Pivot Points Trade Breakout “Role Reversal.”

Let’s look at the pivot points trade breakout role reversal.

Remember that, when support levels break, they usually turn into resistance levels.

This concept of “role reversal” also applies to broken resistance levels, which become support levels. These would have been good opportunities to take the “I think I’ll play it safe” method.

Where do you place stops and pick targets with breakouts?

One of the difficult things about taking breakout trades is picking a spot to place your stop.

Unlike range trading, where you are looking for breaks of pivot point support and resistance levels, you are looking for strong fast moves.

Once a level breaks, in theory, that level will probably become “support-turned-resistance” or “resistance-turned-support.” Again, this is called a role reversal…since the roles have been reversed.

If you were going long and the price broke R1, you could place your stop just below R1.

Let’s go back to that EUR/USD chart to see where you could place your stops.

As for setting targets, you would typically aim for the next pivot point support or resistance level as your take-profit point.

It’s very rare that the price will break past all the pivot point levels unless a big economic event or surprise news comes out.

Example

Let’s go back to that EUR/USD chart to see where you would put those stops and take profit.

In this example, once you saw the price break R1, you would have set your stop just below R1.

If you believed that the price would continue to rise, you could keep your position and move your stop manually to see if the move would continue.

You’d have to watch carefully and adjust accordingly.

You’ll learn more about this in later lessons.

As with any method or indicator, you have to be aware of the risks of taking breakout trades.

Risks

First of all, you have no idea whether or not the move will continue.

You might enter thinking that the price will continue to rise, but instead, you catch a top or bottom, which means that you’ve been faked out!

Second, you won’t be sure if it’s a true breakout or just wild moves caused by the release of important news.

Spikes in volatility are a common occurrence during news events.

So be sure to keep up with breaking news and be aware of what’s on the economic calendar for the day or week.

Lastly, just like in range trading, it would be best to pop on other key support and resistance levels.

You might be thinking that R1 is breaking, but you failed to notice a strong resistance level just past R1.

Price may break past R1, test the resistance, and just fall back down.

You should make use of your forex knowledge of support and resistance, candlestick patterns, and momentum indicators to help you give stronger signals about whether the break is real or not.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.