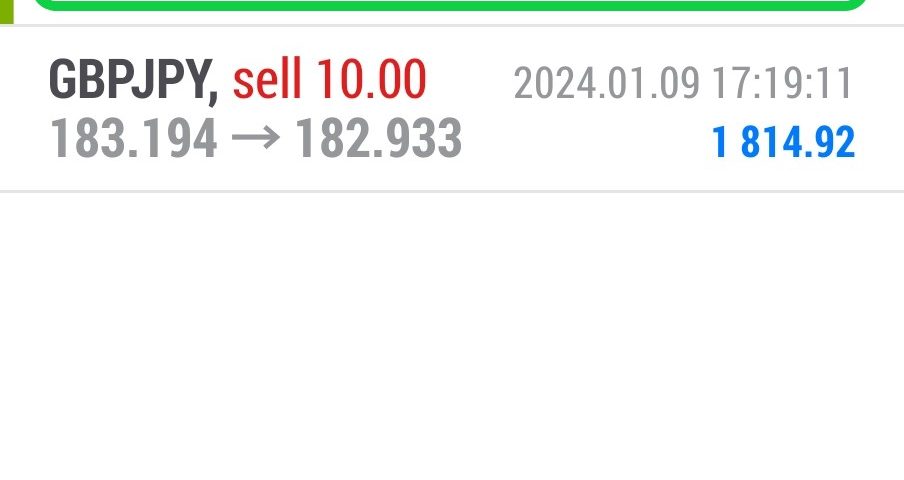

Forex Smart Trade Results, Tuesday, January 9, 2024 – $3,064

Forex Smart Trade Results, Monday, January 8, 2024 – $1,213

January 16, 2024

Forex Smart Trade Results, Wednesday, January 10, 2024 – $6,797

January 16, 2024Capital Flows.

Globalization, technological advances, and the internet have all contributed to the ease of investing your money virtually anywhere in the world, regardless of where you call home.

You’re only a few clicks of the mouse away (or a phone call for you folks living in the Jurassic era of the 2000s) from investing in the New York or London Stock Exchange, trading the Nikkei or Hang Seng Index, or from opening a forex account to trade U.S. dollars, euros, yen, and even exotic currencies.

Capital flows measure the amount of money flowing into and out of a country or economy because of capital investment purchasing and selling.

The important thing you want to keep track of is capital flow balance, which can be positive or negative.

Positive Capital Flow

When a country has a positive capital flow balance, foreign investments coming into the country are greater than investments heading out of the country.

Negative Capital Flow

A negative capital flow balance is the direct opposite.

Investments leaving the country for some foreign destinations are greater than investments coming in.

With more investment coming into a country, demand increases for that country’s currency as foreign investors have to sell their currency to buy the local currency.

This demand causes the currency to increase in value.

Simple supply and demand.

And you guessed it, if supply is high for a currency (or demand is weak), the currency tends to lose value.

When foreign investments make an about-face, and domestic investors also want to switch teams and leave, then you have an abundance of the local currency as everybody is selling and buying the currency of whatever foreign country or economy they’re investing in.

Foreign capital is nothing more than a country with high-interest rates and strong economic growth.

If a country also has a growing domestic financial market, even better!

A booming stock market, high-interest rates…

What’s not to love?! Foreign investment comes streaming in.

And again, as demand for the local currency increases so does its value.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.