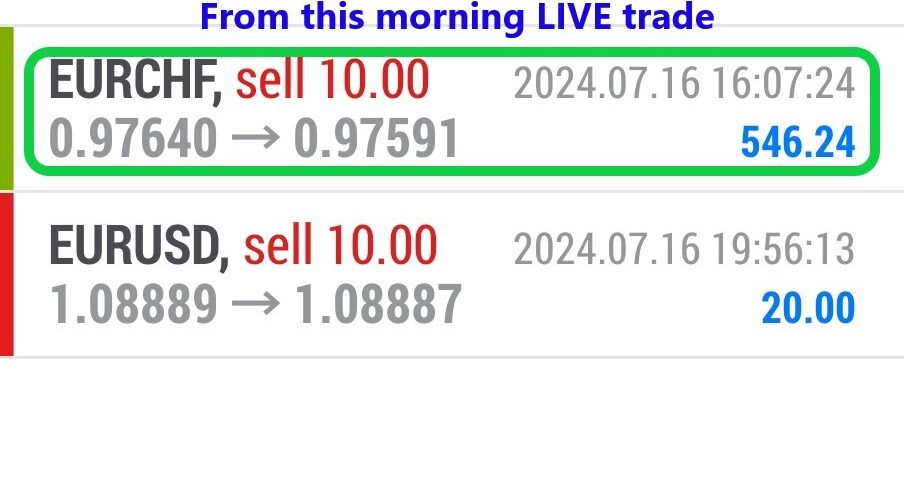

Forex Smart Trade Results, Tuesday, July 16, 2024 – $4,497

Forex Smart Trade Results, Monday, July 15, 2024 – (212)

July 29, 2024

Forex Smart Trade Results, Wednesday, July 17, 2024 – $1,202

July 29, 2024Trading EUR/USD.

EUR/USD is traded in amounts denominated in euros. Standard lot sizes are 100,000 EUR and mini lot sizes are 10,000 EUR.

The pip value, which is denominated in U.S. dollars, is calculated by dividing 1 pip of EUR/USD (that’s 0.0001) by EUR/USD’s rate.

Profit and loss are denominated in U.S. dollars.

For one standard lot position size, each pip movement is worth 10 USD.

For one mini lot position size, each pip movement is worth 1 USD.

Margin calculations are based in US dollars.

For instance, if the current EUR/USD rate is 1.4000 and the leverage is 100:1, it will take $1,400.00 USD in the available margin to be able to trade one standard lot position of 100,000 EUR.

As EUR/USD’s rate increases, a larger available margin in U.S. dollars is required.

The lower the EUR/USD rate, the lower the required available margin in U.S. dollars.

EUR/USD Trading Tactics

Pro-euro moves, which typically take place upon the release of strong economic figures from the eurozone, create opportunities for long EUR/USD trades.

Anti-euro moves, which usually occur when weak eurozone economic reports are released, provide a basis for a short EUR/USD trade.

Since EUR/USD usually acts as a measure of traders’ view on the U.S. dollar, sensing the direction of the U.S. dollar could create some trade strategies for EUR/USD.

For instance, if traders are expected to buy the dollar if the U.S. retail sales report prints better-than-expected results, you could look for an opportunity to short EUR/USD.

Aside from waiting for EUR/USD pair to retest or break significant support and resistance levels, taking a trade based on retracements also works for this pair.

EUR/USD is highly susceptible to retracements, which means that setting short or long orders at significant Fibonacci levels could yield some pips.

By catching retracements, one may be able to enter the trade at a better price than just simply jumping in the direction of the price movement.

If you’re a bit more adventurous, there are other euro pairs, such as EUR/JPY, EUR/CHF, and EUR/GBP, that you can check out!

Each EUR cross has cool and unique characteristics too.

For instance, EUR/JPY, which is more volatile than EUR/USD, tends to be more active during the Asian and London sessions.

EUR/GBP and EUR/CHF tend to be range-bound most of the time.

The latter is more prone to large spikes though due to lower levels of liquidity.

Learn to Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.