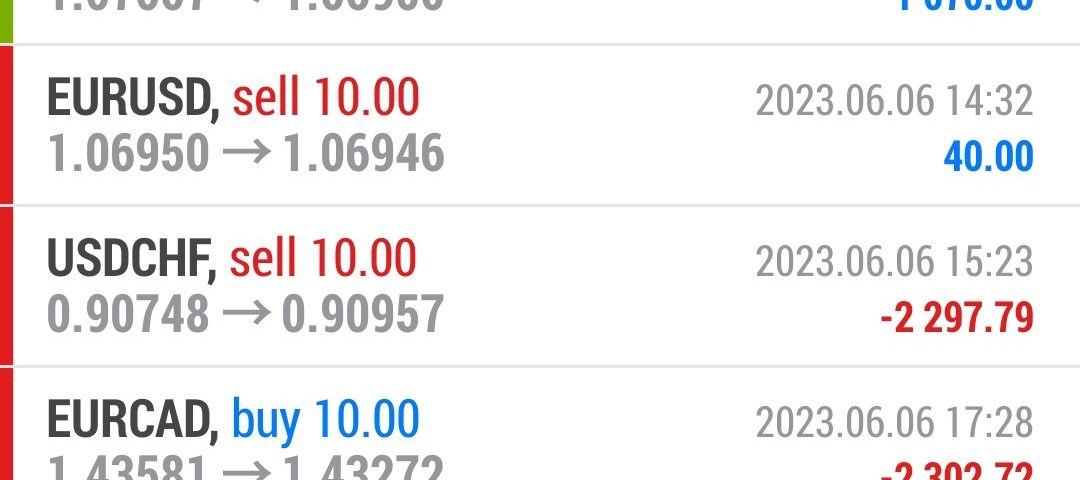

Forex Smart Trade Results, Tuesday, June 6, 2023 – ($1,137)

Forex Smart Trade Results, Monday, June 2, 2023 – $6,513

June 17, 2023

Forex Smart Trade Results, Wednesday, June 7, 2023 – $1,509

June 17, 2023How to Trade Forex Using Keltner Channels.

Now let’s take a look at how to trade forex using Keltner channels.

Keltner Channels show the area where a currency pair normally hangs out.

The channel top typically holds as a dynamic resistance while the channel bottom serves as a dynamic support.

How to Use Keltner Channels as Dynamic Support and Resistance Levels

The most commonly used settings are 2 x ATR (10) for the upper and lower lines and EMA (20), which is the middle line.

This middle line is pretty significant since it tends to act as a pullback level during ongoing trends.

In an UPTREND, the price action tends to be confined to the UPPER HALF of the channel.

This is between the middle line as support and the top line as resistance.

In a DOWNTREND, price action usually hangs around the BOTTOM HALF of the channel.

You’ll find resistance at the middle line and support at the bottom line.

In a RANGING MARKET, price usually swings back and forth between the top and bottom lines.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.