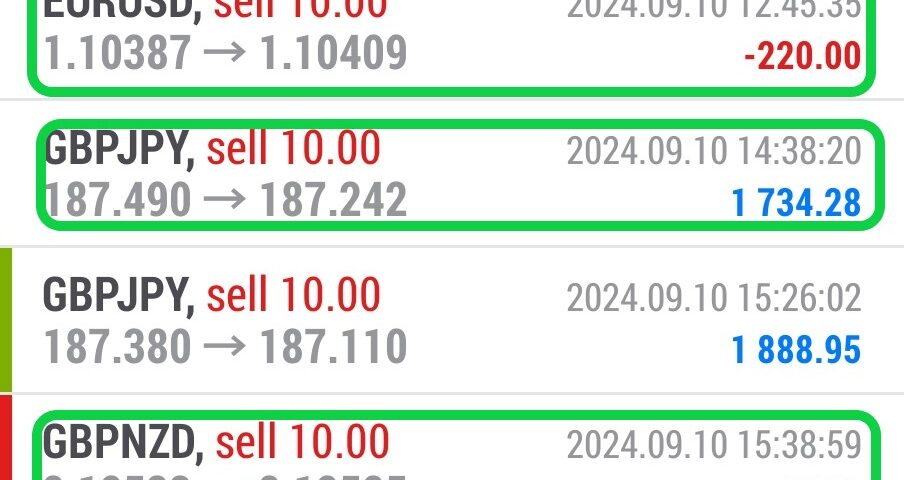

Forex Smart Trade Results, Tuesday, September 10, 2024 – $8,590

Forex Smart Trade Results, Monday, September 9, 2024 – $3,504

October 14, 2024

Forex Smart Trade Results, Wednesday, September 11, 2024 – $6,569

October 14, 2024China: Monetary & Fiscal Policy.

The People’s Bank of China (PBoC), which is located in Beijing, is in charge of China’s monetary policies.

Aside from controlling interest rates and reserve ratio requirements, the PBoC is also tasked with regulating financial institutions in mainland China.

Now here’s a little piece of trivia for you: Did you know that the PBoC currently holds the most financial assets among all the public financial institutions in existence?

It is currently holding over $1.3 TRILLION USD worth of Treasury bills, and not to mention all the other bonds from other countries that are on its balance sheet!

This shouldn’t be too surprising considering how China managed to trump most nations in terms of economic performance!

Another interesting factoid about the PBoC is that its interest rates used to be divisible by 9 instead of 25 a few years back.

This was because the Chinese based their rate system on the abacus, which was set in multiples of 9. Can you imagine reading about a 0.18% hike in benchmark rates?

Recently, however, the PBoC decided to let go of this traditional practice and adopt the convention of hiking or cutting interest rates by 0.25% increments.

In fact, the PBoC is pretty notorious for making aggressive interest rate changes depending on how the Chinese economy is faring.

Aside from the interest rate, the PBoC also has the ability to adjust the reserve ratio requirement (RRR) for banks in its monetary policy arsenal.

You see, the RRR refers to the amount of cash Chinese banks are required to hold in their vaults. y varying the ratio, the PBoC is able to control how much money is in circulation and keep inflation within its target levels.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.