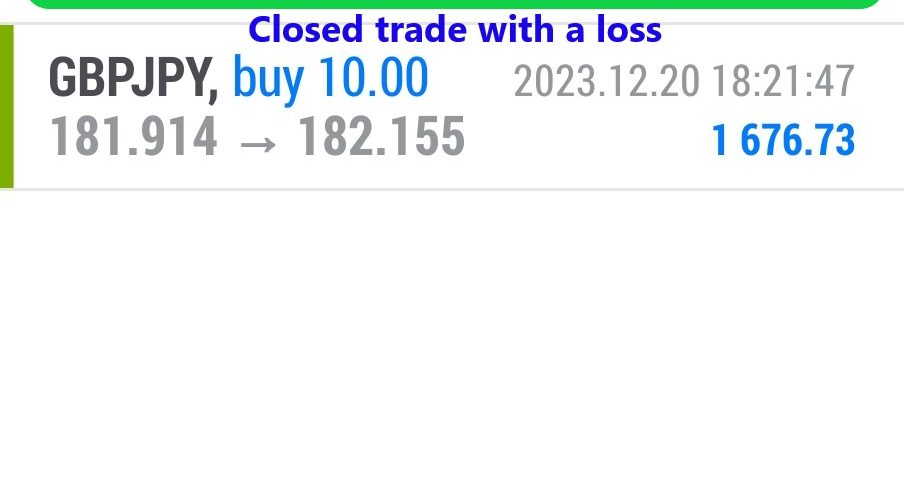

Forex Smart Trade Results, Wednesday, December 20, 2023 – $2,050

Forex Smart Trade Results, Tuesday, December 19, 2023 – $7,184

December 26, 2023

Forex Smart Trade Results, Thursday, December 21, 2024 – $9,736

December 26, 2023Trading Breakouts.

With breakout trades, the goal is to enter the market right when the price makes a breakout and then continue to ride the trade until volatility dies down.

Breakouts are significant because they indicate a change in the supply and demand of the currency pair you are trading.

You’ll notice that, unlike trading stocks or futures, there is no way for you to see the volume of trades made in the forex. Because of this, we need to rely on volatility.

Volatility measures the overall price fluctuations over a certain time and this information can be used to detect potential breakouts.

Chart Indicators to Measure Volatility

There are a few indicators that can help you gauge a pair’s current volatility.

Using these indicators can help you tremendously when looking for breakout opportunities.

- Moving Averages (MAs)

- Bollinger Bands (BB)

- Average True Range (ATR)

Types of Breakouts

There are two types of breakouts:

- Continuation

- Reversal

How to Spot Breakouts

To spot breakouts, you can look at:

- Chart Patterns

- Trend lines

- Channels

- Triangles

How to Measure Breakout Strength

You can measure the strength of a breakout using the following:

- Moving Average Convergence/Divergence (MACD)

- Relative Strength Index (RSI)

Finally, breakouts usually work best, and FOR REAL with some kind of economic event or news catalyst.

Always be sure to check the economic calendar for upcoming news before figuring out whether or not a breakout trade is the right play for the situation.

Learn to Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.