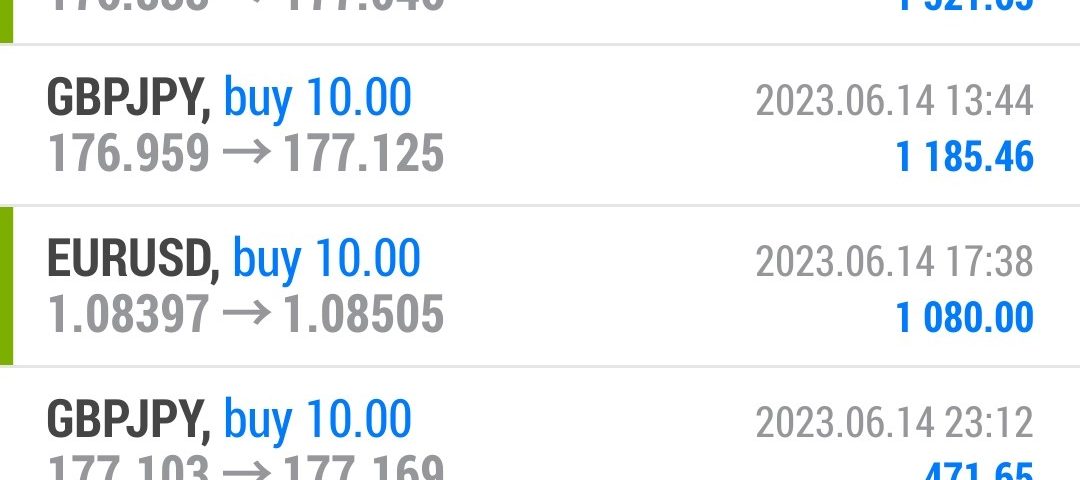

Forex Smart Trade Results, Wednesday, June 14, 2023 – $2,220

Forex Smart Trade Results, Tuesday, June 13, 2023 – $11,055

June 21, 2023

Forex Smart Trade Results, Thursday, June 15, 2023 – $29,501

July 9, 2023How to use Parabolic SAR to exit trades.

Now let’s review how to use parabolic SAR to exit trades.

You can also use Parabolic SAR to help you determine whether you should close your trade or not.

Check out how the Parabolic SAR worked as an exit signal in EUR/USD’s daily chart below.

When EUR/USD started sliding down in late April, it seemed like it would just keep droppin’ like a rock.

A trader who was able to short this pair has probably wondered how low it’d continue to go.

In early June, three dots formed at the bottom of the price, suggesting that the downtrend was over and that it was time to exit those shorts.

If you stubbornly decided to hold on to that trade thinking that EUR/USD would resume its drop, you would’ve probably erased all those winnings since the pair eventually climbed back near 1.3500.

Learn to Currency Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.