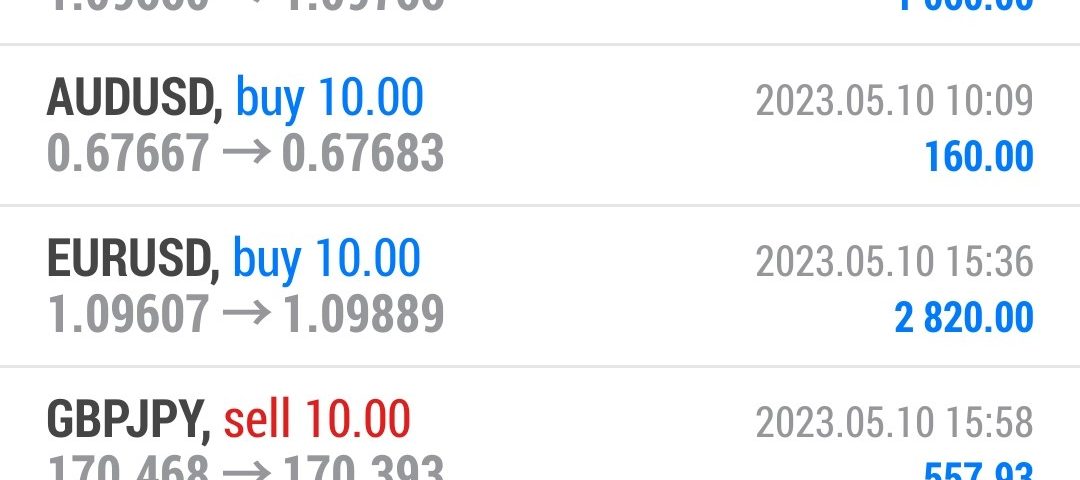

Forex Smart Trade Results – Wednesday, May 10, 2023 – $9,958

Forex Smart Trade Results, Tuesday, May 9, 2023 – $3,687

May 21, 2023

Forex Smart Trade Results, Thursday, May 11, 2023 – $6,776

May 21, 2023How to Set Up the Guppy Multiple Moving Average.

Let’s take a look at how to set up the Guppy multiple moving average.

This technique consists of combining TWO groups of exponential moving averages (EMAs) with differing time periods (or lengths).

The twelve periods used are 3, 5, 8, 10, 12, 15, 30, 35, 40, 45, 50, and 60.

Short-Term Trend’s Momentum

The 3, 5, 8, 10, 12, and 15 EMAs are used to show the short-term trend’s momentum.

Longer-Term Trend’s Momentum

The 30, 35, 40, 45, 50, and 60 EMAs show the longer-term trend’s momentum.

Now, let’s show both groups of EMAs on the chart.

We can identify trend reversals and continuations with these two groups of EMAs.

How to Use the Guppy Multiple Moving Average

The Guppy Multiple Moving Average identifies changes in trend direction or gauges the strength of the current trend.

How to Identify Trend Strength

The degree of separation between the short- and long-term moving averages can be used as an indicator of trend strength.

Wide Separation

If there’s a WIDE separation, this indicates that the prevailing trend is strong.

Narrow Separation

If there’s a NARROW separation or lines that intertwine, this indicates a weakening trend or a period of consolidation.

Learn How to Successfully Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.