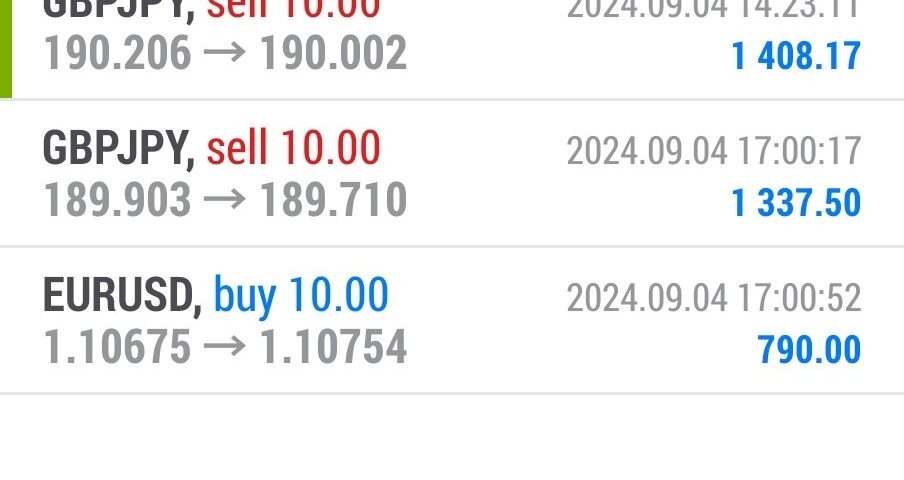

Forex Smart Trade Results, Wednesday, September 4, 2024 – $5,550

Forex Smart Trade Results, Tuesday, September 3, 2024 – $1,027

September 22, 2024

Forex Smart Trade Results, Thursday, September 5, 2024 – $8,602

September 22, 2024What Moves the CHF.

Price of Gold

As mentioned earlier, the CHF has an 80% correlation with the price of gold, as 25% of Switzerland’s cash is backed with gold reserves.

When gold prices go up, the CHF usually goes up as well.

Conversely, when gold prices slide, the CHF likewise declines.

Developments in the Euro Zone and the U.S.

Since Switzerland is an export-dependent country, it is vastly affected by the economic development of its major trading partners in the eurozone and the U.S.

Switzerland’s major export partners in the eurozone are Germany (21.2%), France (8.2%), Italy (7.9%), and Austria (4.5%).

The U.S., meanwhile, takes about 8.7% of Switzerland’s exports.

Poor economic performance in any of these countries could mean less business for Switzerland.

Sortin’ Out the Rough Edges

Political tension in its neighbors in Europe, particularly in the eurozone, could cause traders to seek the safety of the Swissy.

Remember that the eurozone is a brood of 16 states with the ECB directing and implementing a set of monetary policies for the entire group.

Given that the economies of the member countries grow at different paces, ECB policies sometimes go against what a single nation needs at that specific time.

The X-factor

USD/CHF is also affected by the cross-exchange rates like EUR/CHF. A jump in the EUR’s valuation due to a hike in the ECB’s interest rate, for example, could spill the Swissy’s weakness onto other currency pairs like USD/CHF.

Merger and Acquisition (M&A) Activities

Switzerland’s main industry is banking and finance. Merger and acquisition (M&A) activities, or simply the buying and selling of firms, are very common.

How can this affect the spot prices of the CHF?

For example, if a foreign firm wishes to acquire a business in Switzerland, it will have to pay for it using CHF.

On the other hand, if a Swiss bank, for example, wishes to purchase a US firm, it will then have to dump its CHF for the USD.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.