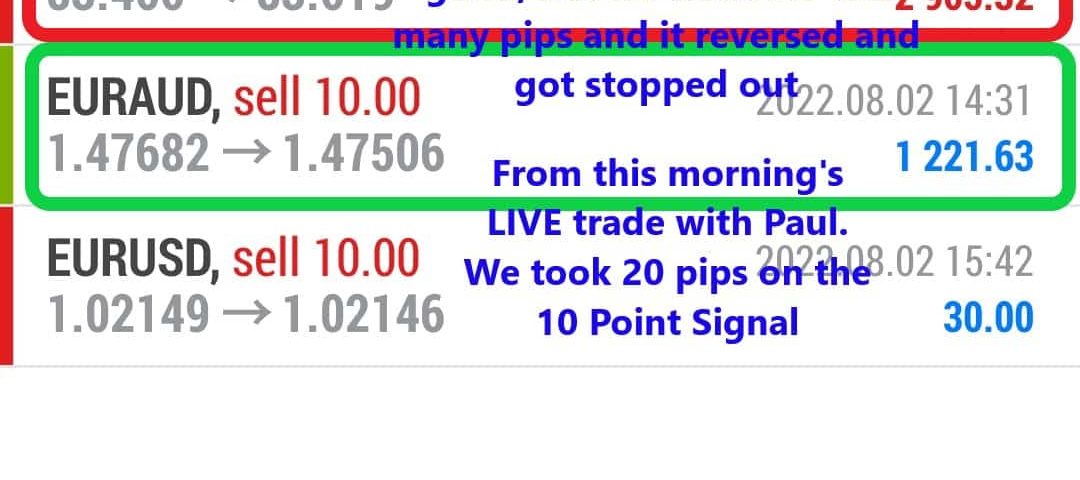

Forex Trade Results August 2, 2022 – $206

Forex Trade Results August 1, 2022 – $4,720

August 1, 2022

Forex Trade Results August 3, 2022 – $3,020

August 3, 2022Stop Out Example: Stop Out Level at 20%.

Here is a stop out example.

Let’s say your forex broker has a Stop Out Level at 20%.

This means that your trading platform will automatically close your position if your Margin Level reaches 20%.

Stop Out Level = Margin Level @ 20%

Let’s continue with the example from the previous lesson, What is a Margin Call Level?

You’ve already received a Margin Call when the Margin Level had reached 100% but still decide not to deposit more funds because you think the market will turn.

Not only are you a sucky trader, but you’re a crazy trader also.

Anyways, your sucky crazy self ends up…absolutely WRONG.

The market continues to fall.

You’re now down 960 pips.

At $1/pip, you now have a floating loss of $960!

This means your Equity is now $40.

Equity = Balance + Floating P/L $40 = $1000 - $960

Your Margin Level is now 20%.

Margin Level = (Equity / Used Margin) x 100% 20% = ($40 / $200) x 100%

*Used Margin can’t go below $200 because that’s the Required Margin that was needed to open the position in the first place.

At this point, your position will be automatically closed (“liquidated”).

When your position is closed, the Used Margin that was “locked up” will be released.

Free Margin

The release will become Free Margin.

The end result for you will be depressing, though.

Your floating loss of $960 will be “realized”, and your new balance will be $40!

Since you don’t have any open trades, your equity and Free Margin will also be $40.

Here’s what your account metrics would look like in your trading platform at each Margin Level threshold:

| Margin Level | Equity | Used Margin | Free Margin | Balance | Floating P/L | |

| Margin Call Level | 100% | $200 | $200 | $0 | $1,000 | -$800 |

| Stop Out Level | 20% | $40 | $200 | $0 | $1,000 | -$960 |

| Stop Out (Liquidation) | – | $ 40 | –0 | $ 40. | $ 40.00 | – |

If you experience a Stop Out and see the aftermath in your account, this is how your eyes feel…

If you had multiple positions open, the broker usually closes the least profitable position first.

Each position that is closed “releases” Used Margin, which increases your Margin Level.

But if closing this position is still not enough to get back the Margin Level above 20%, your broker will continue to close positions until it does.

The Stop Out Level is meant to prevent you from losing more money than you have deposited.

If your trade continued to keep losing, eventually, you’d have no more money in your account and you’d end up with a negative account balance!

Brokers would prefer not to have to come knocking on your door with a baseball bat to collect the unpaid balance, so a Stop Out is meant to try and… STOP… your Balance from going negative.

Learn to Day Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.