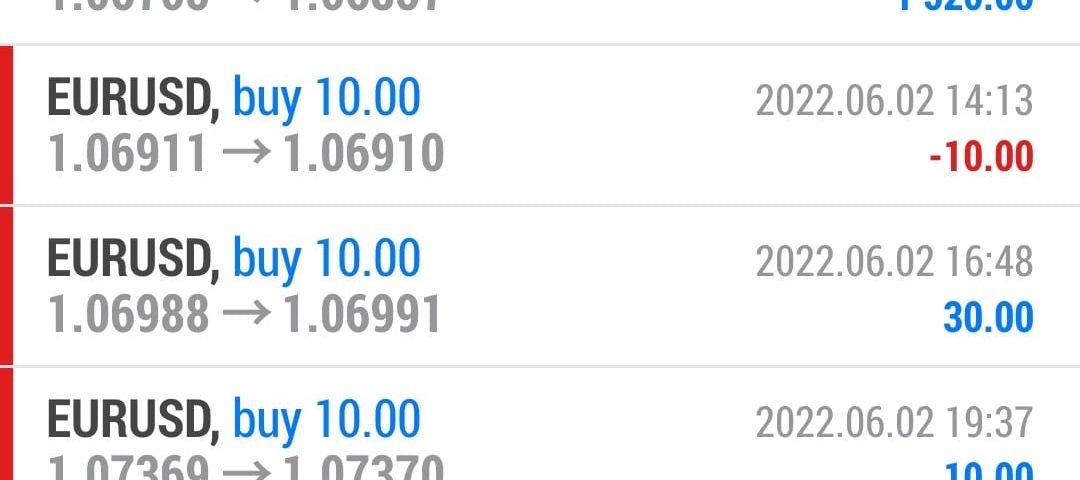

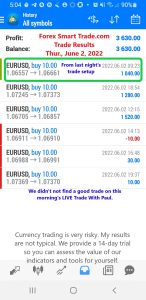

Forex Trade Results June 2, 2022 – $3,630

Forex Trade Results June 1, 2022 – $1,630

June 1, 2022

Forex Trade Results June 3, 2022 – $1.890

June 6, 2022Forex Trading Sessions Overlap.

Forex trading sessions overlap. In between each forex trading session, there is a period where two sessions are open at the same time.

For example, during the summer, from 3:00-4:00 AM ET, the Tokyo session and London session overlap

And during both summer and winter from 8:00 AM-12:00 PM ET, the London session and the New York session overlap.

Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time.

This makes sense because, during those times, all the market participants are wheelin’ and dealin’, which means that more money is transferring hands.

Now let’s take a look at the average pip movement of the major currency pairs during each forex trading session.

| PAIR | TOKYO | LONDON | NEW YORK |

|---|---|---|---|

| EUR/USD | 76 | 114 | 92 |

| GBP/USD | 92 | 127 | 99 |

| USD/JPY | 51 | 66 | 59 |

| AUD/USD | 77 | 83 | 81 |

| NZD/USD | 62 | 72 | 70 |

| USD/CAD | 57 | 96 | 96 |

| USD/CHF | 67 | 102 | 83 |

| EUR/JPY | 102 | 129 | 107 |

| GBP/JPY | 118 | 151 | 132 |

| AUD/JPY | 98 | 107 | 103 |

| EUR/GBP | 78 | 61 | 47 |

| EUR/CHF | 79 | 109 | 84 |

From the table, you will see that the London session normally provides the most movement.

Notice how some currency pairs have much larger pip movements than others.

Learn to Currency Day Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.