Forex Smart Trade Results, Friday, March 31, 2023 – $8,441

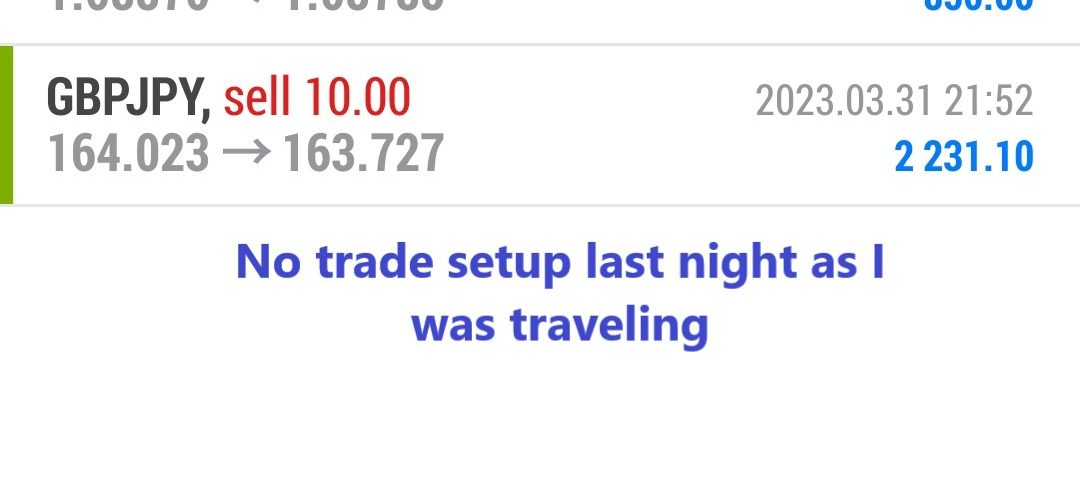

Forex Smart Trade Results, Thursday, March 30, 2023 – $2,254

April 9, 2023

Forex Smart Trade Results, Monday, April 3, 2023 – $5,266

April 10, 2023Using Fibonacci Extensions to Know When to Take Profit.

Let’s pop on the Fibonacci extension tool to see where would have been a good place to take off some profits.

Here’s a recap of what happened after the retracement Swing Low occurred:

- Price rallied all the way to the 61.8% level, which lined up closely with the previous Swing High.

- It fell back to the 38.2% level, where it found support

- Price then rallied and found resistance at the 100% level.

- A couple of days later, the price rallied yet again before finding resistance at the 161.8% level.

As you can see from the example, the 61.8%, 100%, and 161.8% levels all would have been good places to take off some profits.

Now, let’s take a look at an example of using Fibonacci extension levels in a downtrend.

In a downtrend, the general idea is to take profits on a short trade at a Fibonacci extension level since the market often finds support at these levels.

Downtrend Example

Let’s take another look at that downtrend on the 1-hour EUR/USD chart we showed you in the Fib Sticks lesson.

Here, we saw a doji form just under the 61.8% Fib level. Price then reversed as sellers jumped back in, and brought the price all the way back down to the Swing Low.

Let’s put up that Fib Extension tool to see where would have been some good places to take profits had we shorted at the 61.8% retracement level.

Here’s what happened after the price reversed from the Fibonacci retracement level:

- Price found support at the 38.2% level

- The 50.0% level held as initial support, then became an area of interest

- The 61.8% level also became an area of interest, before the price shot down to test the previous Swing Low

- If you look ahead, you’ll find out that the 100% extension level also acted as support

We could have taken off profits at the 38.2%, 50.0%, or 61.8% levels. All these levels acted as support, possibly because other traders were keeping an eye out for these levels for profit-taking as well.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.