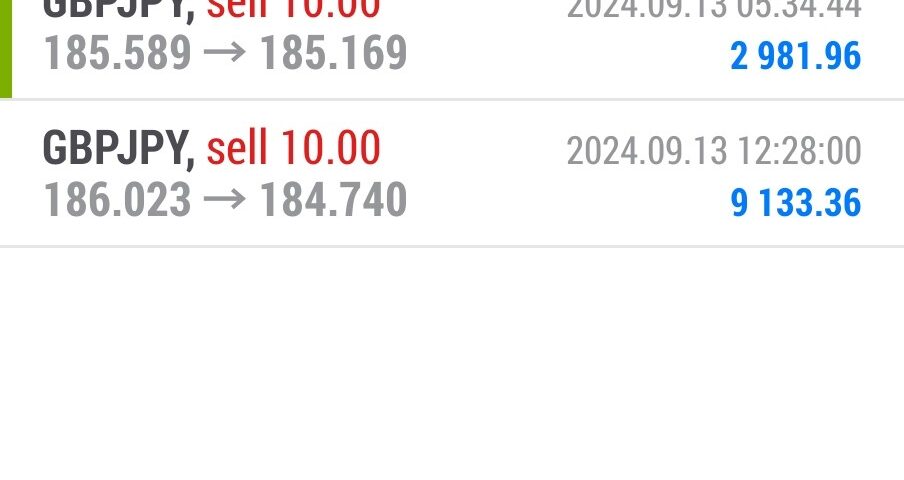

Forex Smart Trade Results, Friday, September 13, 2024 – $7,079

Forex Smart Trade Results, Thursday, September 12, 2024 – $9,655

October 14, 2024

Forex Smart Trade Results, Monday, September 16, 2024 – $5,969

October 14, 2024China: Trading the Chinese Economic Reports.

Even though the yuan isn’t a commonly traded currency, that doesn’t mean you can’t make any pips off those Chinese economic releases!

Because China’s economy is so ginormous, its economic events will most likely impact those nations that they are closely associated with.

One of these is Australia.

China is Australia’s largest trading partner, with the two nations exchanging nearly a hundred billion dollars worth of products each year.

With that, Chinese economic data releases tend to impact the Australian dollar the most among the major currency pairs.

Strong economic data from China typically indicates that the Chinese demand for Australian commodities could increase while weak Chinese data could hint at a downturn in trade with Australia.

Of course, since China is currently the world’s second-largest economy next to Uncle Sam, its economic standing also has a huge effect on risk sentiment.

This means that a slowdown in China could reduce traders’ appetite for risk and higher-yielding currencies as they worry about the potential impact of this slump on the global economy.

On the other hand, an economic boom in China could be positive for risk as market participants see this as a sign of further growth for the global economy.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.