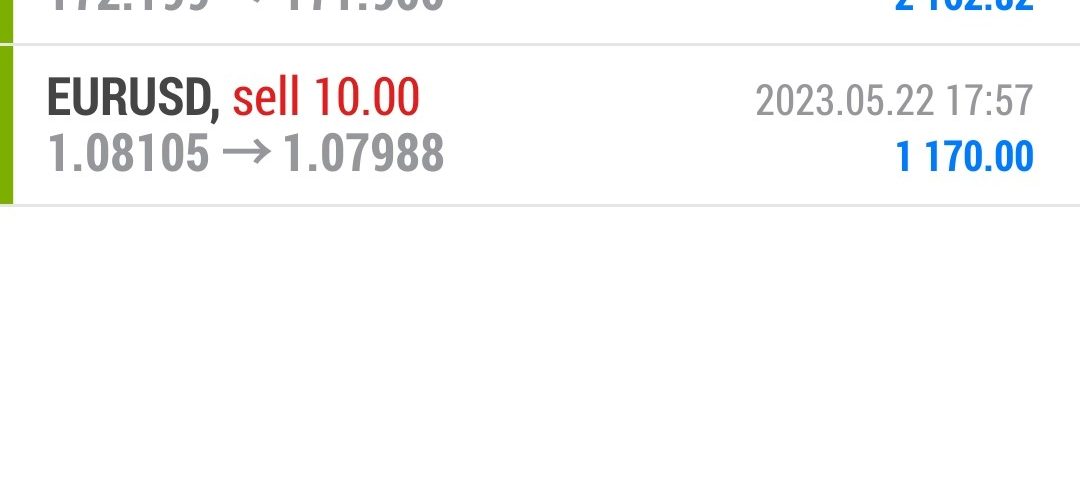

Forex Smart Trade Results, Monday, May 22, 2023 – $7,623

Forex Smart Trade Results, Friday, May 19, 2023 – $6,894

June 3, 2023

Forex Smart Trade Results, Tuesday, May 23, 2023 – $7,354

June 4, 2023Bollinger Bands.

Bollinger Bands, a technical indicator developed by John Bollinger.

They are used to measure a market’s volatility and identify “overbought” or “oversold” conditions.

Basically, this little tool tells us whether the market is quiet or whether the market is LOUD!

When the market is quiet, the bands contract.

And when the market is LOUD, the bands expand.

Look at the chart below.

Chart

The Bollinger Bands (BB) is a chart overlay indicator meaning it’s displayed over the price.

Notice how when the price is quiet, the bands are close together. When the price moves up, the bands spread apart.

The upper and lower bands measure volatility or the degree of variation of prices over time.

Because the bands measure volatility, the bands adjust automatically to changing market conditions.

That’s all there is to it.

Yes, we could go on and bore you by going into the history of the Bollinger Bands, how it is calculated, the mathematical formulas behind it, and so on and so forth.

Next, let’s focus on describing what are Bollinger Bands.

Trading Forex Coaching

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.