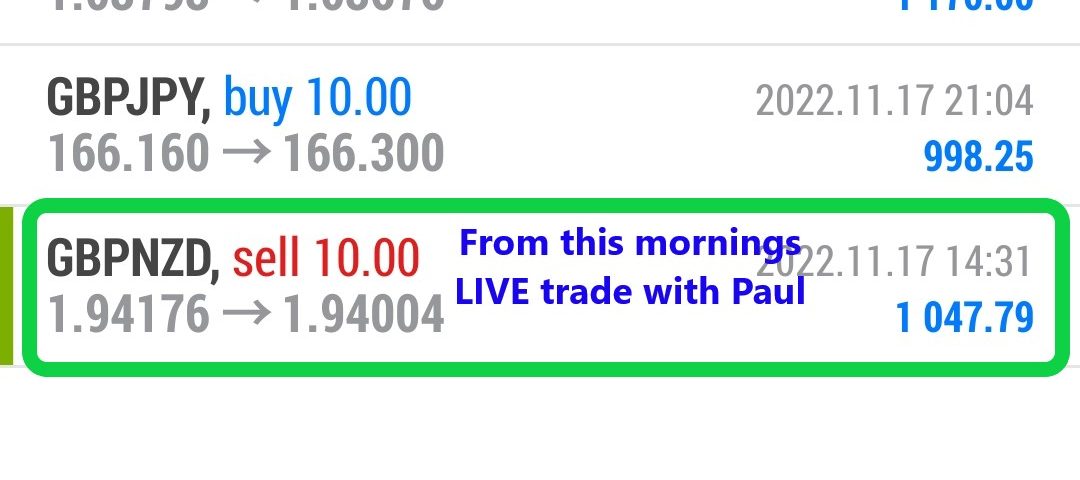

Forex Smart Trade Results November 17, 2022 – $4,128

Forex Smart Trade Results November 16, 2022 – TRAVELING NO TRADES TODAY

December 3, 2022

Forex Smart Trade Results November 18, 2022 – $2,528

December 3, 2022Large Forex Brokers.

For larger forex brokers, because they have many customers opening trades in both (long and short) directions, they are able to internally offset (“internalize”) much of their order flow.

Internally offsetting the order flow allows the broker to minimize their market risk WITHOUT having to hedge with an external counterparty.

When not all the positions can be hedged, they then hedged externally the excess market risk exposure.

A large customer base allows most large forex brokers to theoretically offset most of their customers’ trades with each other.

This allows revenue to be earned from customers’ transaction fees (from the spread).

So it is the volume of customer trading that drives revenue, not customers’ losses.

For smaller brokers, if they cannot hedge their trade with another one of their customers, they “B-Book” (take the other side of) the trade.

And they will do this up to their market risk limit.

External Hedging

They would hedge externally anything above this limit.

The use of B-Book combined with only externally hedging beyond a certain risk limit provides better order execution.

This allows the broker to immediately execute your trade.

It also keeps latency and its costs to a minimum.

This is because they don’t have to A-Book or STP every trade, which would mean paying the LP’s spread every time.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.