Scalp trading, also known as scalping, is a popular trading strategy characterized by relatively short time periods between the opening and closing of a trade.

These types of trades are usually only held onto for a few seconds to a few minutes at the most!

The main objective for forex scalpers is to grab very small amounts of pips as many times as they can throughout the busiest times of the day.

Its name is derived from the way its goals are achieved. A trader is literally trying to “scalp” lots of small profits from a huge number of trades throughout the day.

Why Scalp?

What makes scalping so attractive to traders?

Smaller moves happen more frequently than larger ones, even in relatively calm markets. This means that there are many small movements from which a scalper can benefit.

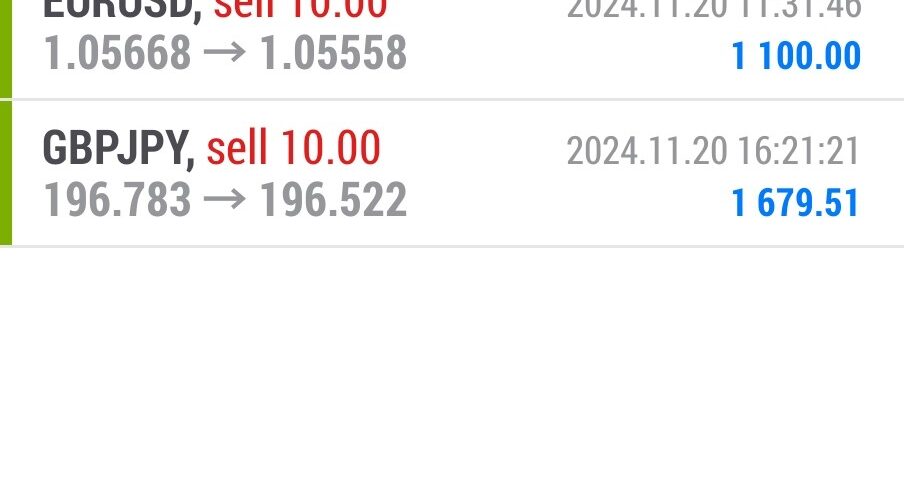

Scalpers can place up to a few hundred trades in a single day, seeking small profits.

All positions are closed at the end of the trading day.

Because scalpers basically have to be glued to the charts, it is best suited for those who can spend several hours of undivided attention on their trading.

It requires intense focus and quick thinking to be successful. Not everyone can handle such fast and demanding trading.

It is not for those looking to make big wins all the time, but rather for those who like raking in small profits over the long run to make an overall profit.

The Strategy

The strategy behind scalping is that lots of small wins can easily morph into large gains.

These small wins are achieved by trying to profit from quick changes in the bid-ask spread.

Scalping focuses on larger position sizes for smaller profits in the shortest period of holding time: from a few seconds to minutes.

The assumption is that price will complete the first stage of a movement in a short span of time so you aim to take advantage of market volatility.

Market volatility is a scalper’s best friend!

With high market volatility, scalpers can open a long position, close it quickly, open a short position, close that, go long again….you get the picture.

The main goal of scalping is to open a position at the ask or bid price and then quickly close the position a few points higher or lower for a profit.

A scalper wants to quickly “cross the spread“.

For example, if you go long EUR/USD, with a bid-ask spread of 2 pips, your position instantly starts with an unrealized loss of 2 pips.

Remember, when you buy, you buy at the ask price. But in order to exit, you need to sell, which is the bid price.

A scalper wants that 2-pip loss to turn into a gain as fast as possible. In order to do this, the bid price needs to rise enough so it’s higher than the ask price that the trade initially entered at.