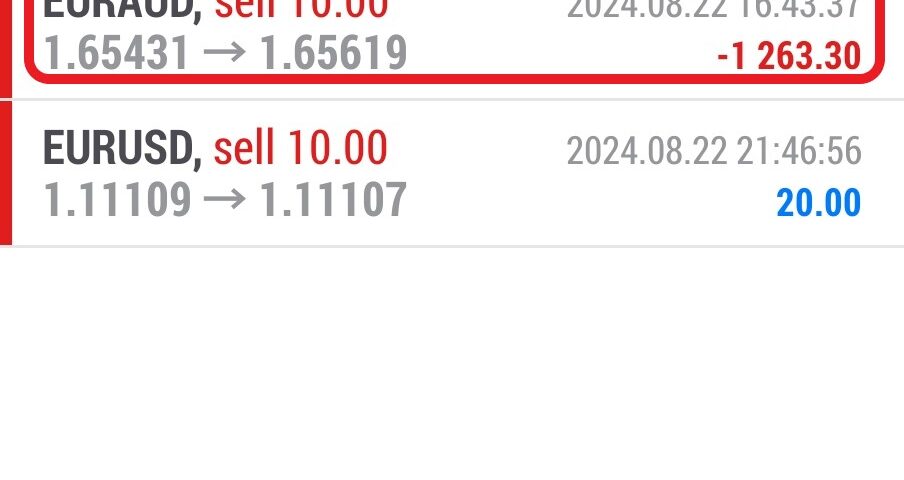

Forex Smart Trade Results, Thursday, August 22, 2024 – $2,900

Forex Smart Trade Results, Wednesday, August 21, 2024 – $2,998

September 7, 2024

Forex Smart Trade Results, Friday, August 23, 2024 – (1,730)

September 7, 2024New Zealand: Monetary & Fiscal Policy.

The Reserve Bank of New Zealand (RBNZ) is in charge of the monetary and fiscal policy of the nation.

Currently headed by Governor Alan Bollard, the RBNZ holds monetary policy meetings eight times a year.

The RBNZ is tasked with maintaining price stability, setting interest rates, and monitoring output and exchange rates.

To achieve price stability, the RBNZ must ensure that annual inflation meets the 1.5% central bank target… otherwise, the government has the right to kick the RBNZ Governor out of office (We’re not kidding).

The RBNZ has the following tools in its monetary policy arsenal:

The official cash rate (OCR), which affects short-term interest rates, is set by the RBNZ Governor.

By lending 25 basis points above this rate and borrowing at 25 basis points below the OCR to commercial banks, the central bank is able to control the interest rates offered to individuals and businesses.

Open market operations are used to meet the cash target or the amount of reserves parked in commercial banks.

By forecasting the cash target daily, the RBNZ is able to calculate how much money to inject into the economy in order to meet the target.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.