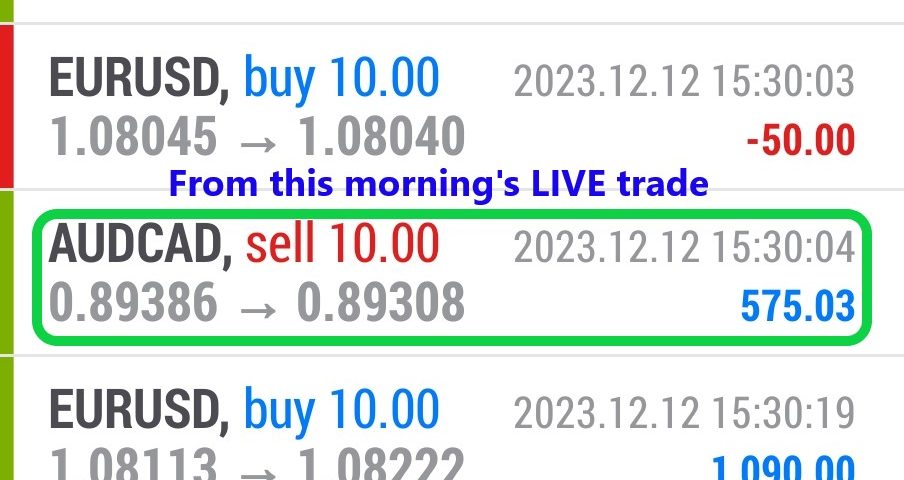

Forex Smart Trade Results, Tuesday, December 12, 2023 – $5,392

Forex Smart Trade Results, Monday, December 11, 2023 – $6,107

December 18, 2023

Forex Smart Trade Results, Wednesday, December 13, 2023 – $14,924

December 19, 2023Measuring the Strength of a Breakout.

Let’s take a look at more on measuring the strength of a breakout with the relative strength index.

Relative Strength Index (RSI)

RSI is another momentum indicator that is useful for confirming reversal breakouts.

Basically, this indicator tells us the changes between higher and lower closing prices for a given period of time. We won’t go into too much detail about it but if you would like to know more check out our lesson on RSI.

RSI can be used in a similar way to MACD in that it also produces divergences. By spotting these divergences, you can find possible trend reversals.

However, RSI is also good for seeing how long a trend has been overbought or oversold.

A common indication of whether they overbought a market is if the RSI is above 70. On the flip side, a common indication of whether it oversold a market is if the RSI is below 30.

Because trends are movements in the same direction for an extended period, you will often see RSI move into overbought/oversold territory, depending on the direction of the trend.

If a trend has produced oversold or overbought readings for an extended period and begins to move back within the range of the RSI, it is a good indication that the trend may be reversing.

In the same example as before, the RSI showed that they overbought the market for a billion days (ok not that long).

Once RSI moved back below 70, it was a good indication that the trend was about to reverse.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.