The Forex Bid, Ask and Spread

What is the bid, the ask and the spread in forex?

All forex quotes are quoted with two prices: the bid and ask.

In general, the bid is lower than the ask price.

What is the“Bid” Price?

The bid is the price at which your broker is willing to buy the base currency in exchange for the quote currency.

This means the bid is the best available price at which you (the trader) can sell to the market.

If you want to sell something, the broker will buy it from you at the bid price.

What is the “Ask” Price?

The ask is the price at which your broker will sell the base currency in exchange for the quote currency.

This means the ask price is the best available price at which you can buy from the market.

Another word for the ask price is the offer price.

If you want to buy something, the broker will sell (or offer) it to you at the ask price.

What is the “Spread”?

The difference between the bid and the ask price is known as the SPREAD.

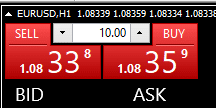

On the EUR/USD quote below, the bid price is 1.08356 and the ask price is 1.08381.

- If you want to sell EUR, you click “Sell” and you will sell euros at 1.08356.

- If you want to buy EUR, you click “Buy” and you will buy euros at 1.08381.

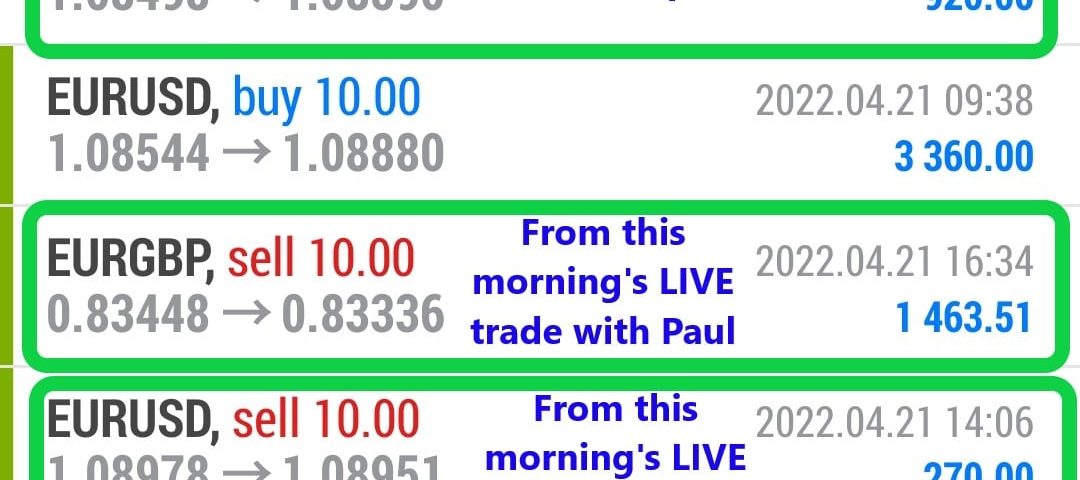

Here’s an illustration that puts together everything we’ve covered in this lesson: