Trade Results

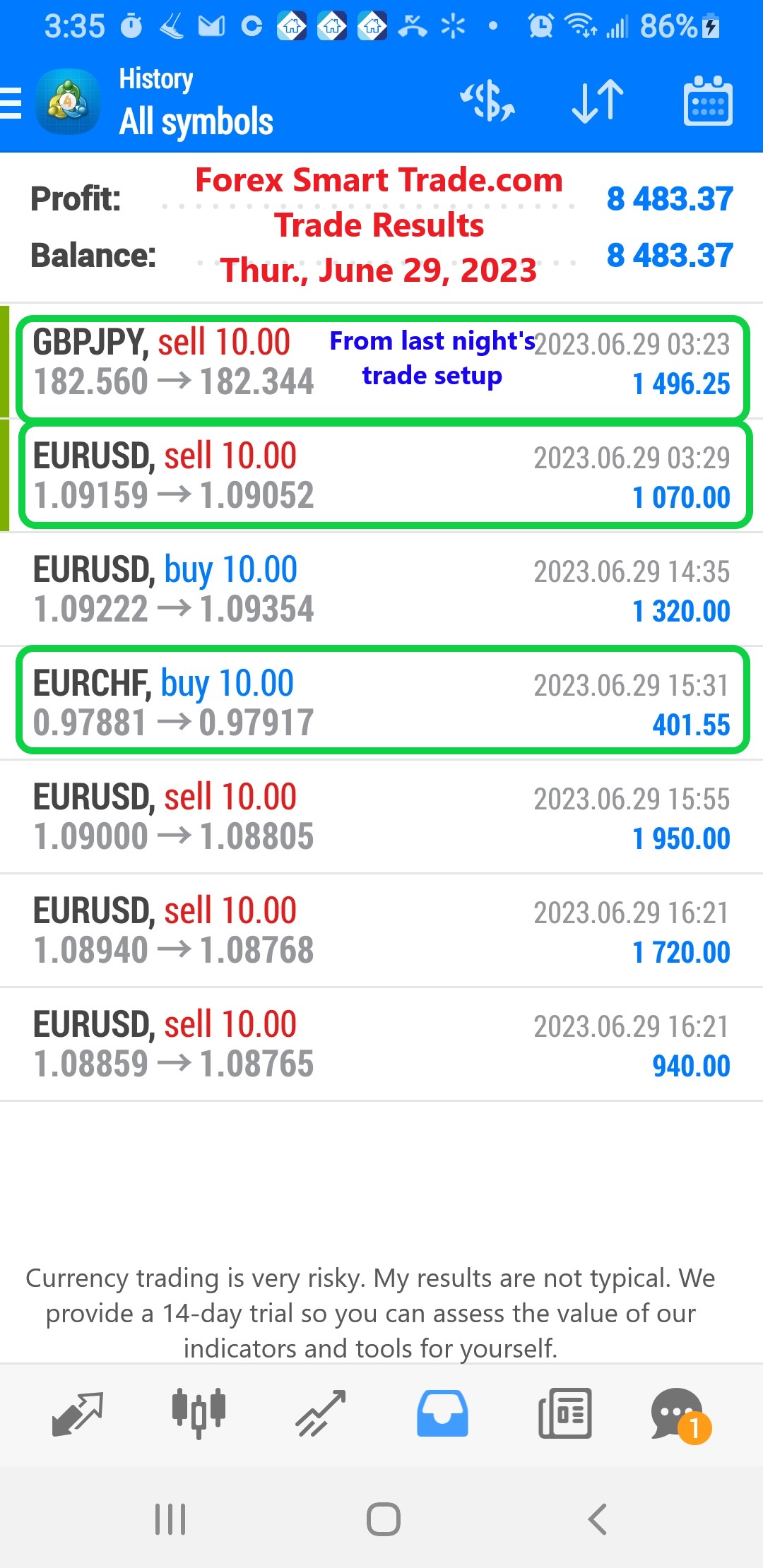

Forex Smart Trade Results, Thursday, June 29, 2023 – $8,483

More About Ichimoku Kinko Hyo. Now let’s try to find out more about Ichimoku Kinko Hyo and what each of the lines is for. Kijun Sen […]

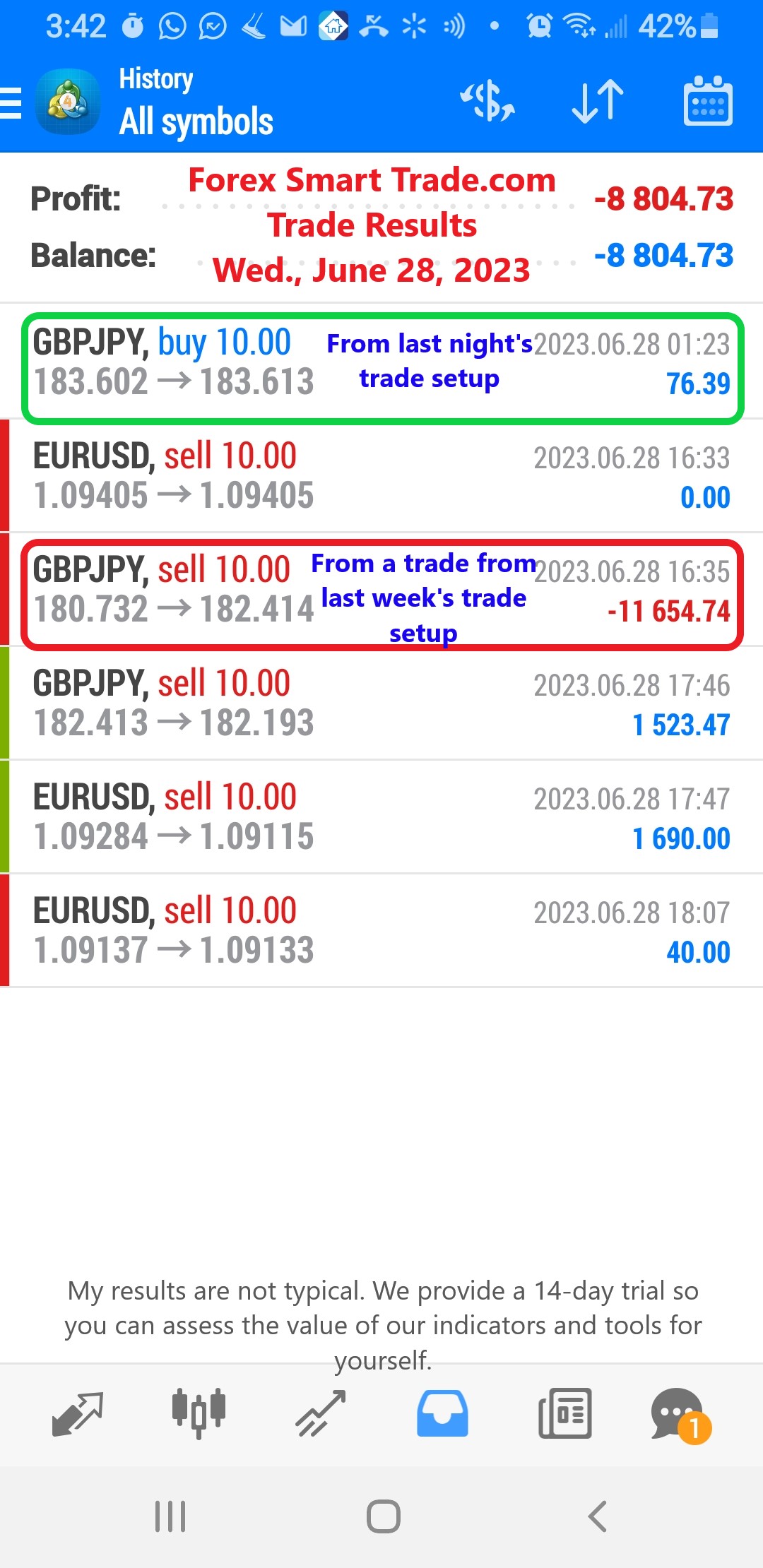

Forex Smart Trade Results, Wednesday, June 28, 2023 – ($8,804)

Ichimoku Kinko Hyo. Let’s examine a technique known as Ichimoku Kinko Hyo (IKH). No, “Ichimoku Kinko Hyo” ain’t Japanese for “May the pips be with you.” […]

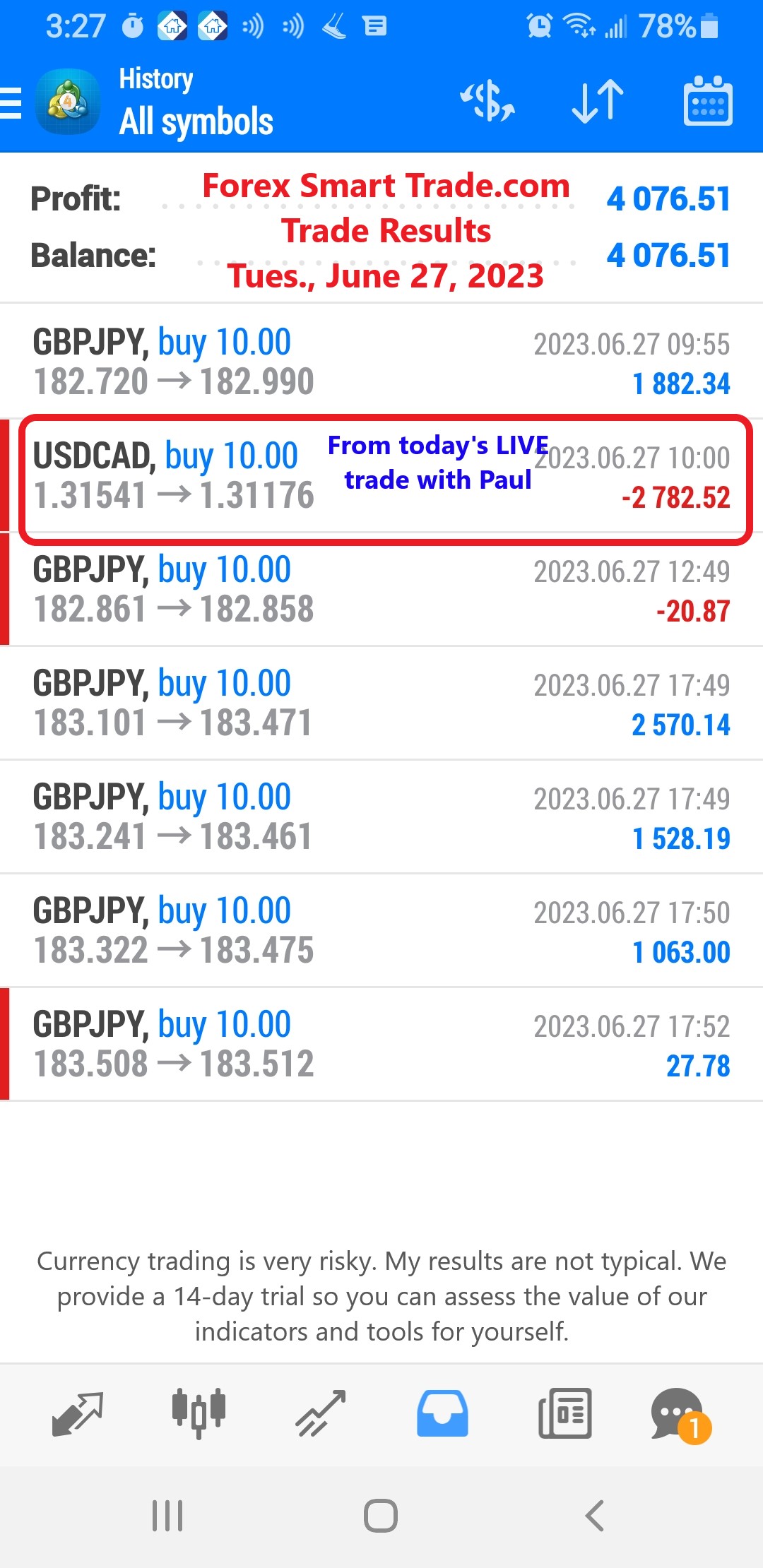

Forex Smart Trade Results, Tuesday, June 27, 2023 – $4,076

How to Trade Using ADX. One way to trade using ADX is to wait for breakouts first before deciding to go long or short. They can use ADX […]

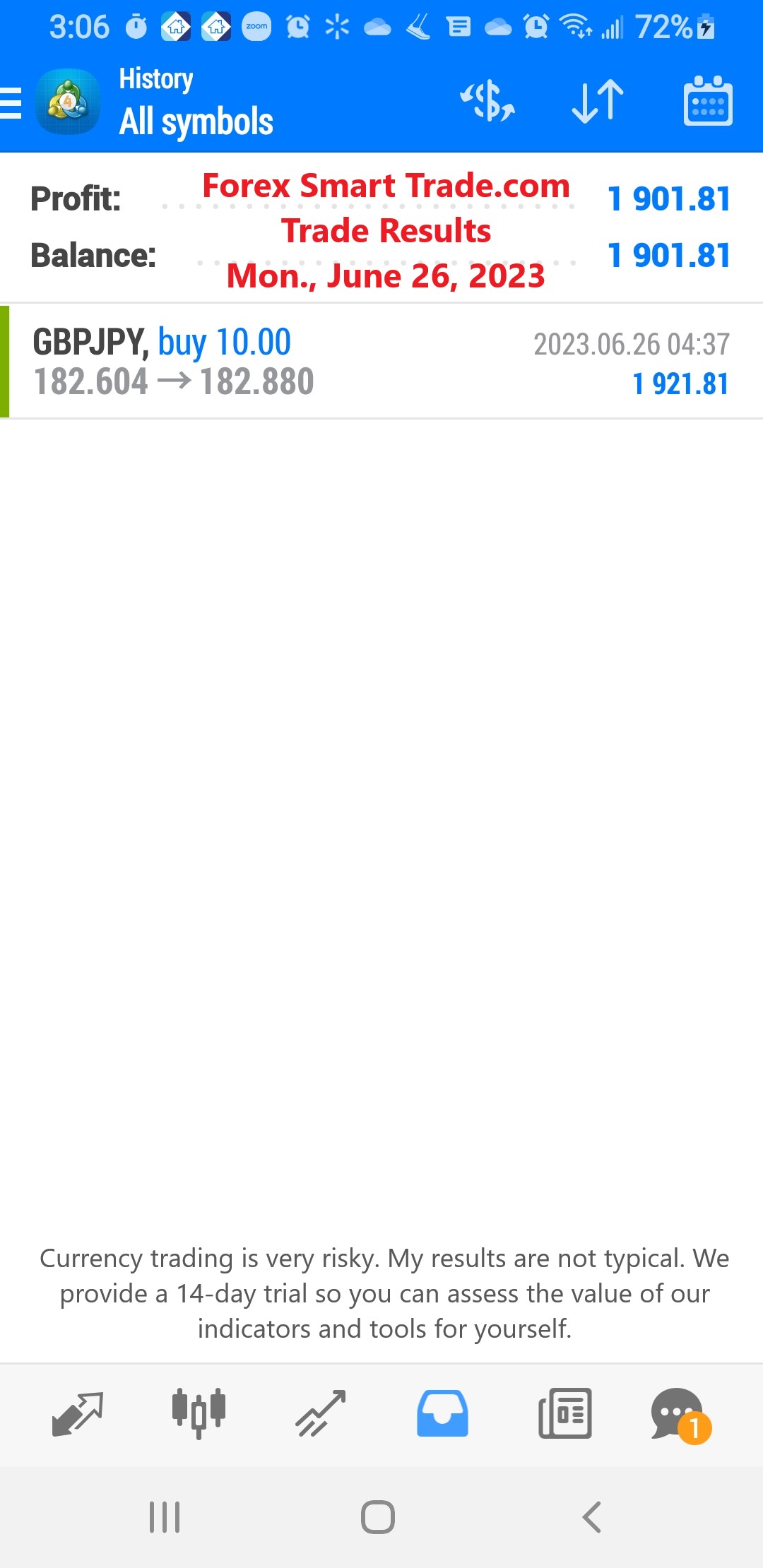

Forex Smart Trade Results, Monday, June 26, 2023 – $1,901

How to Use ADX. When you’re using the ADX indicator, keep an eye on the 20 and 40 as key levels. here’s a little cheat sheet […]

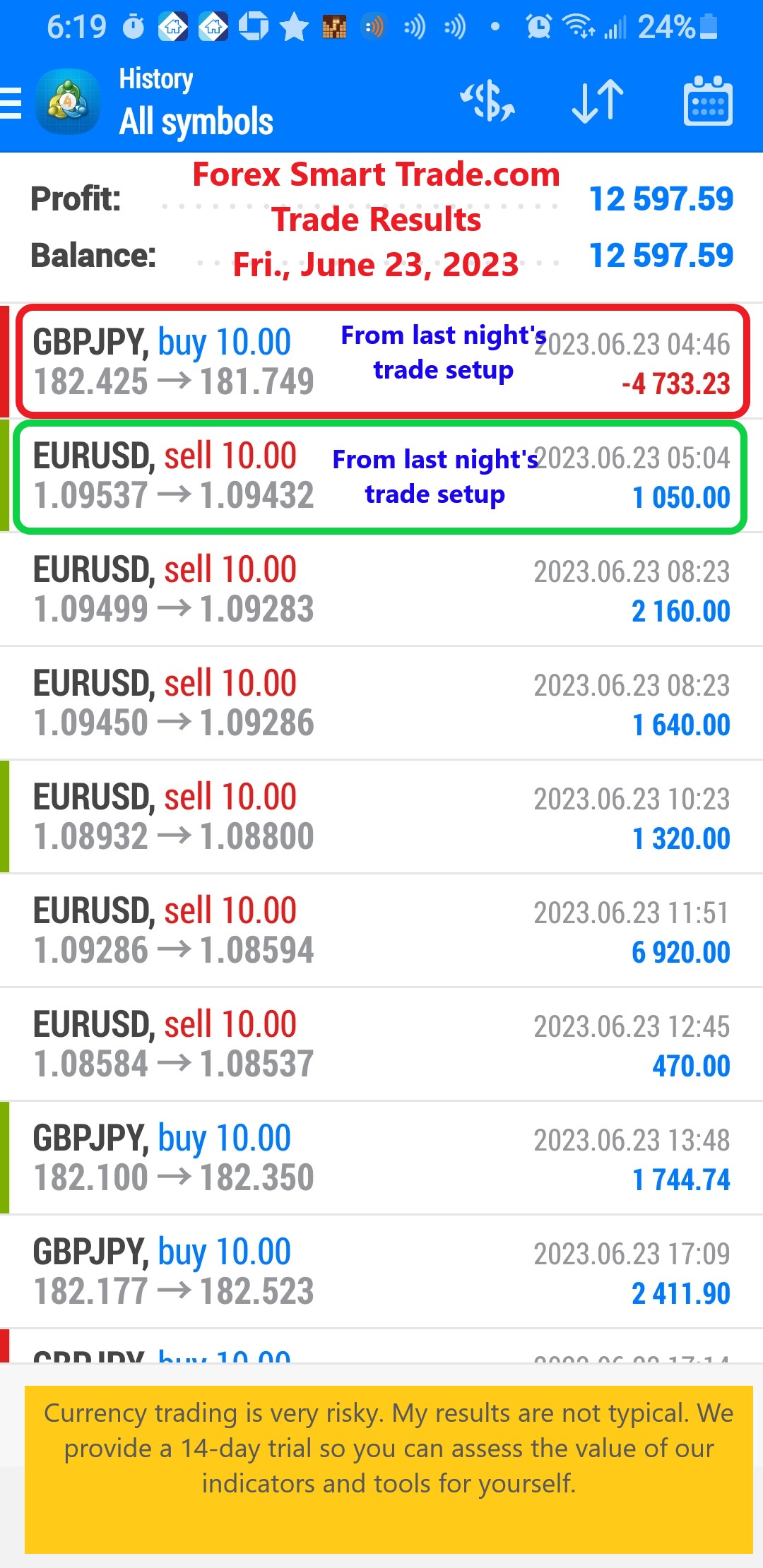

Forex Smart Trade Results, Friday, June 23, 2023 – $12,597

How to Use ADX (Average Directional Index). Let’s take a look at how to use the ADX (average directional index). When trading, it’s helpful to gauge […]

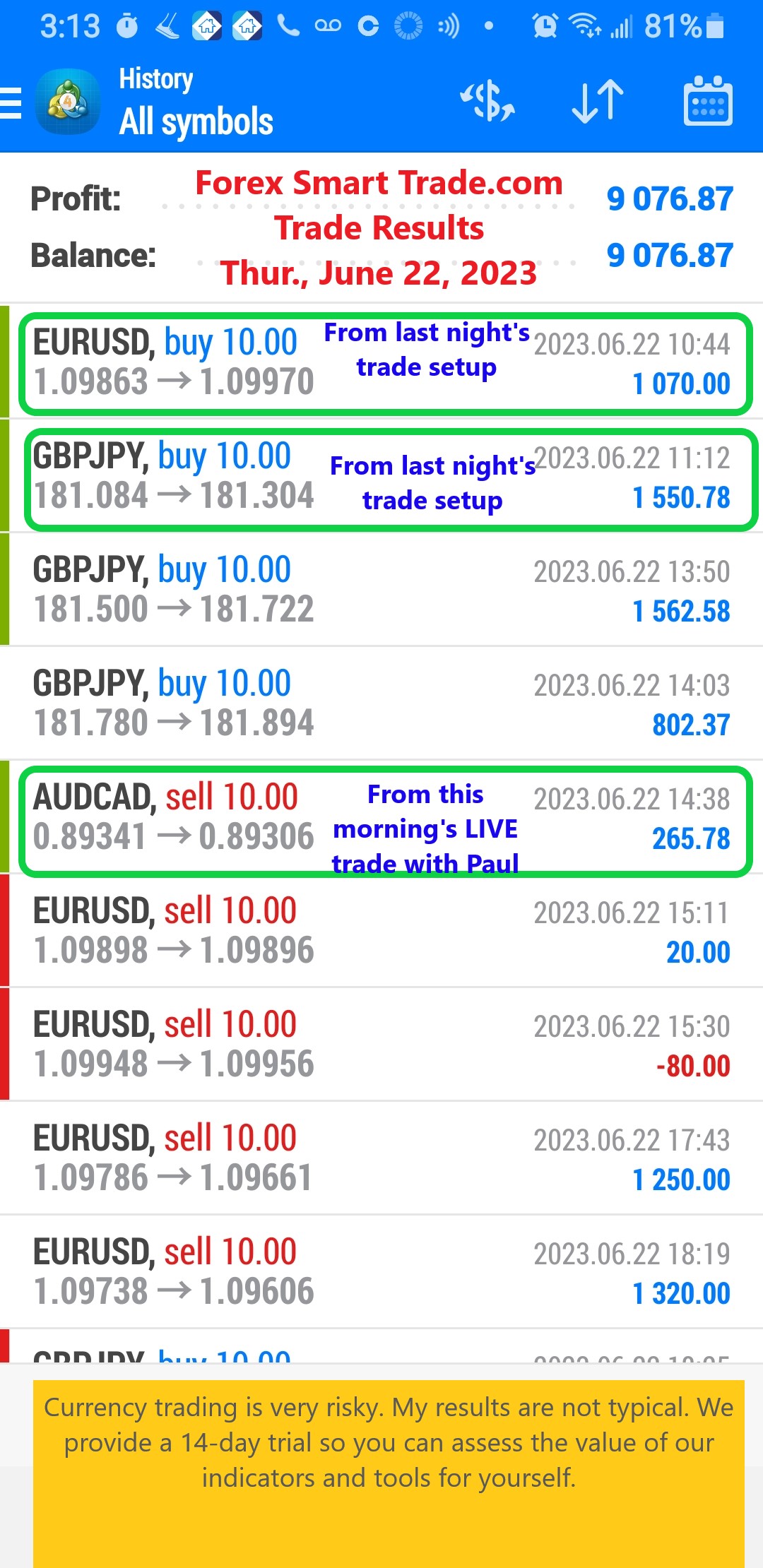

Forex Smart Trade Results, Thursday, June 22, 2023 – $9,076

Determining Trend Strength Using %R. Let’s look at determining trend strength using %R. Williams %R’s sensitivity to volatile prices comes in handy when you want to […]

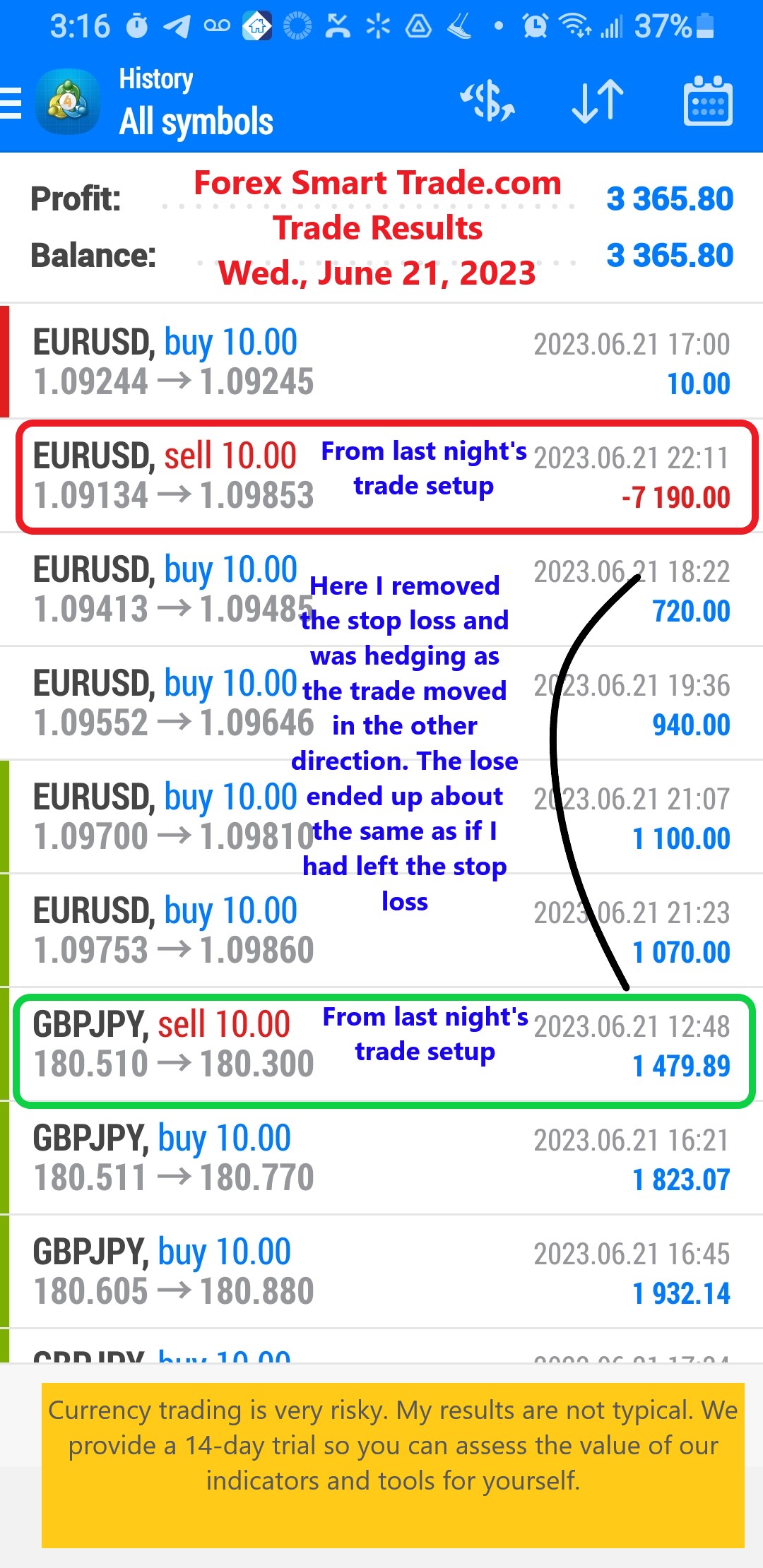

Forex Smart Trade Results, Wednesday, June 21, 2023 – $3,365

How to Use Williams %R (Williams Percent Range). The Williams Percent Range, also called Williams %R, is a momentum indicator that shows you where the last closing price is relative […]

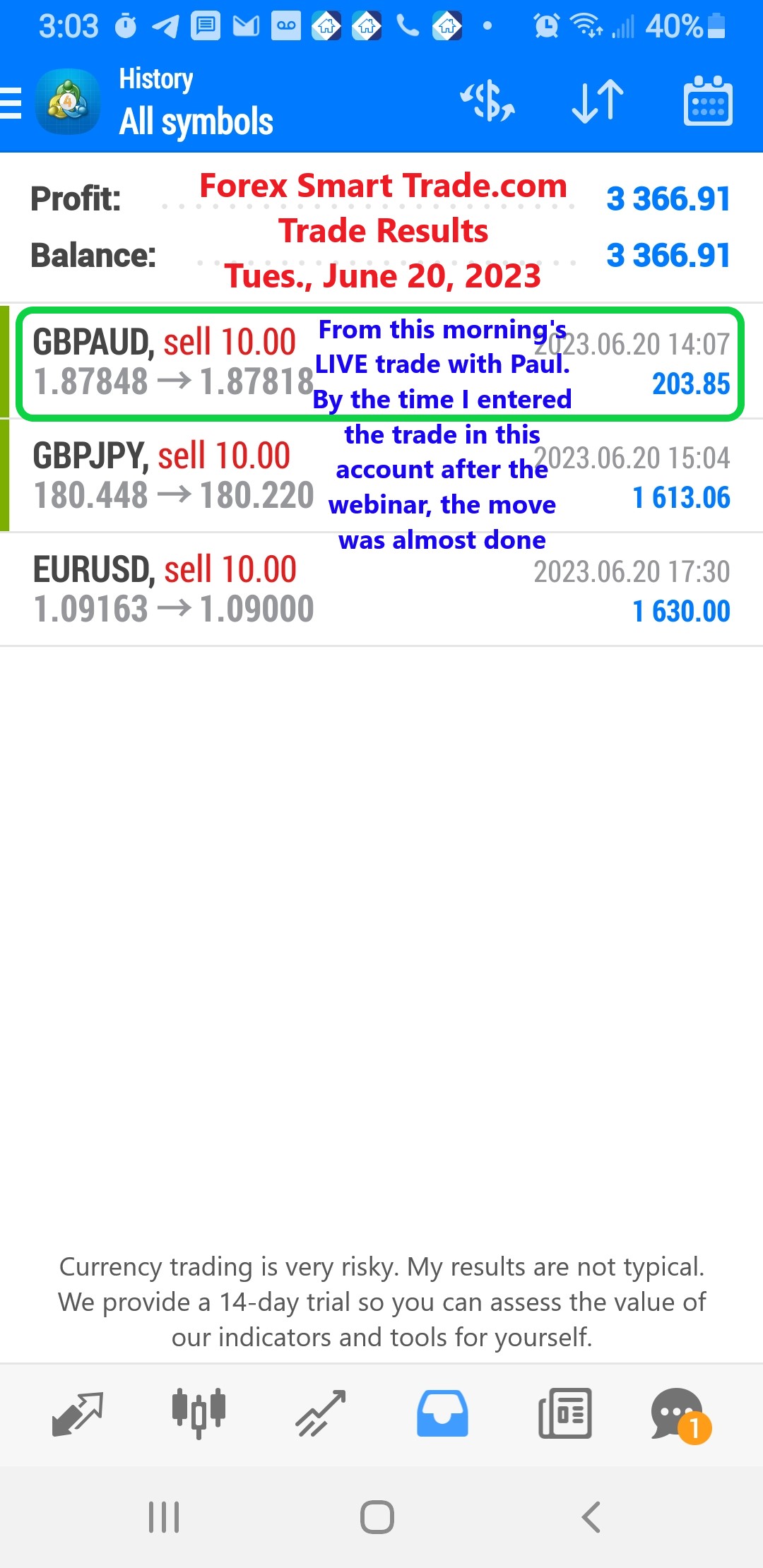

Forex Smart Trade Results, Tuesday, June 20, 2023 – $3,366

How to Trade Using RSI. RSI can be used just like the Stochastic indicator. We can use it to pick potential tops and bottoms depending on whether […]

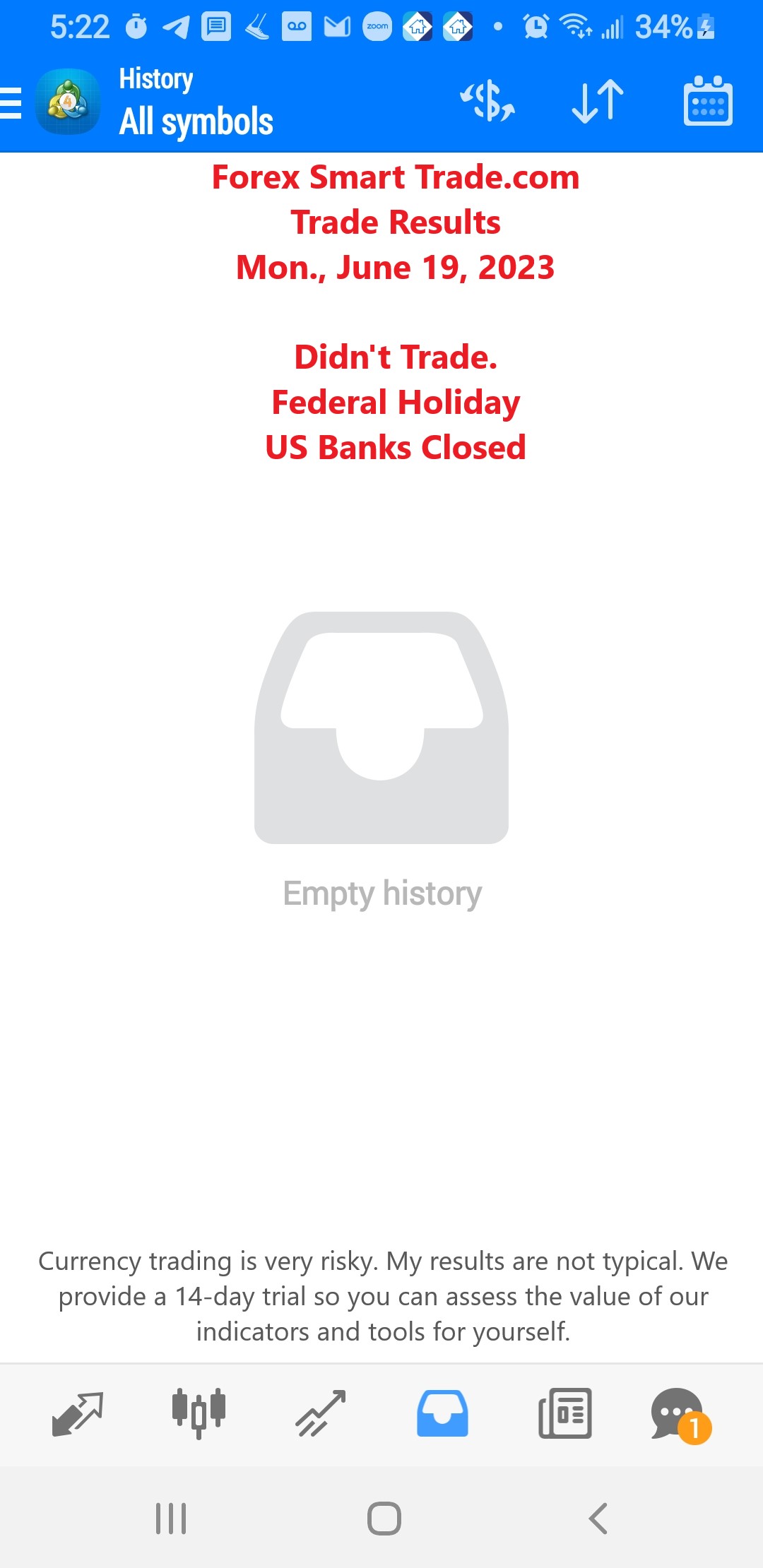

Forex Smart Trade Results, Monday, June 19, 2023 – $0 – Federal Holiday

How to Use RSI (Relative Strength Index). Relative Strength Index, or RSI, is a popular indicator developed by a technical analyst named J. Welles Wilder. The RSI […]

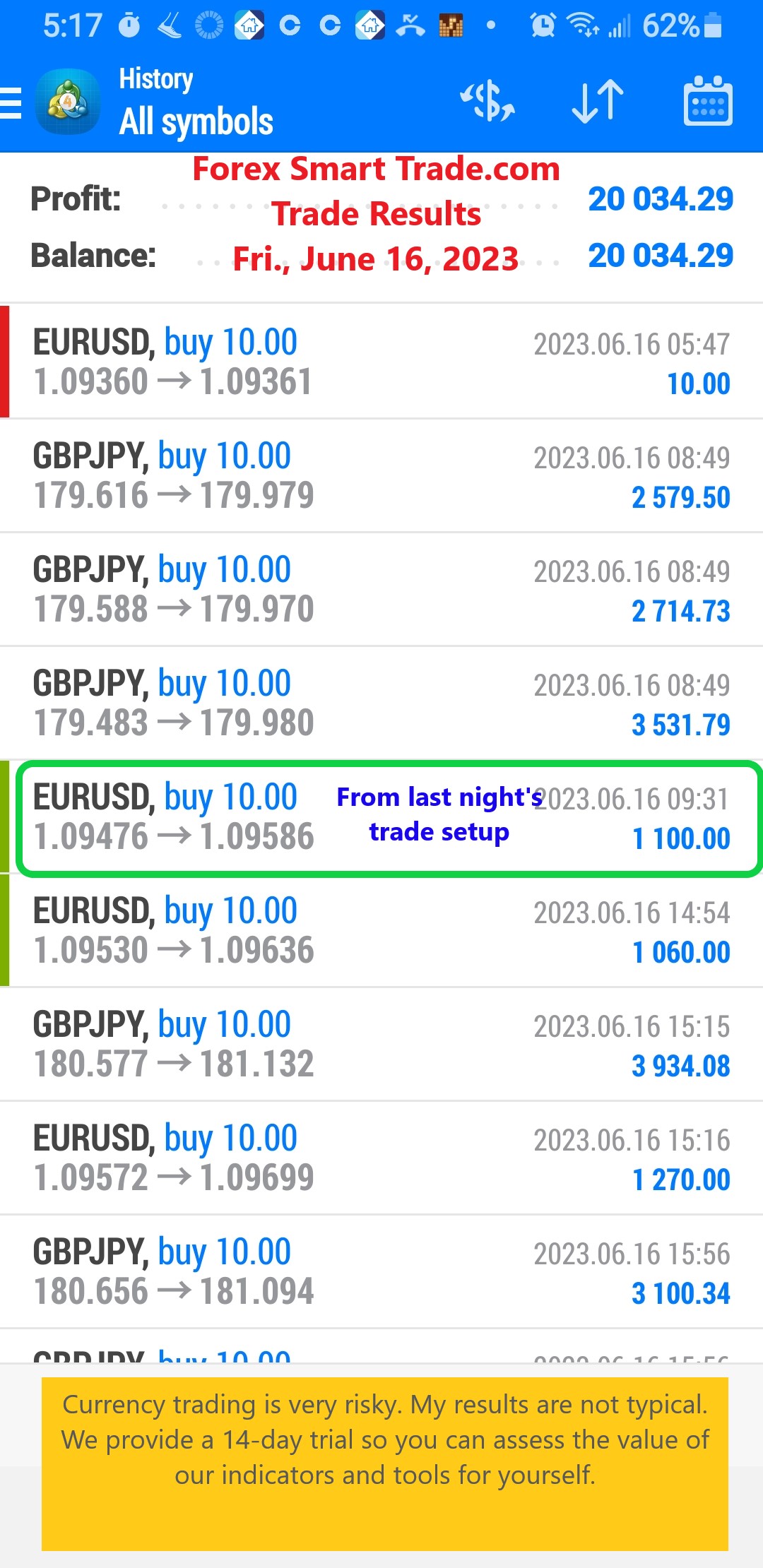

Forex Smart Trade Results, Friday, June 16, 2023 – $20,034

How to Trade Forex Using the Stochastic Indicator. The Stochastic technical indicator tells us when the market is overbought or oversold. The Stochastic is scaled from 0 to 100. […]

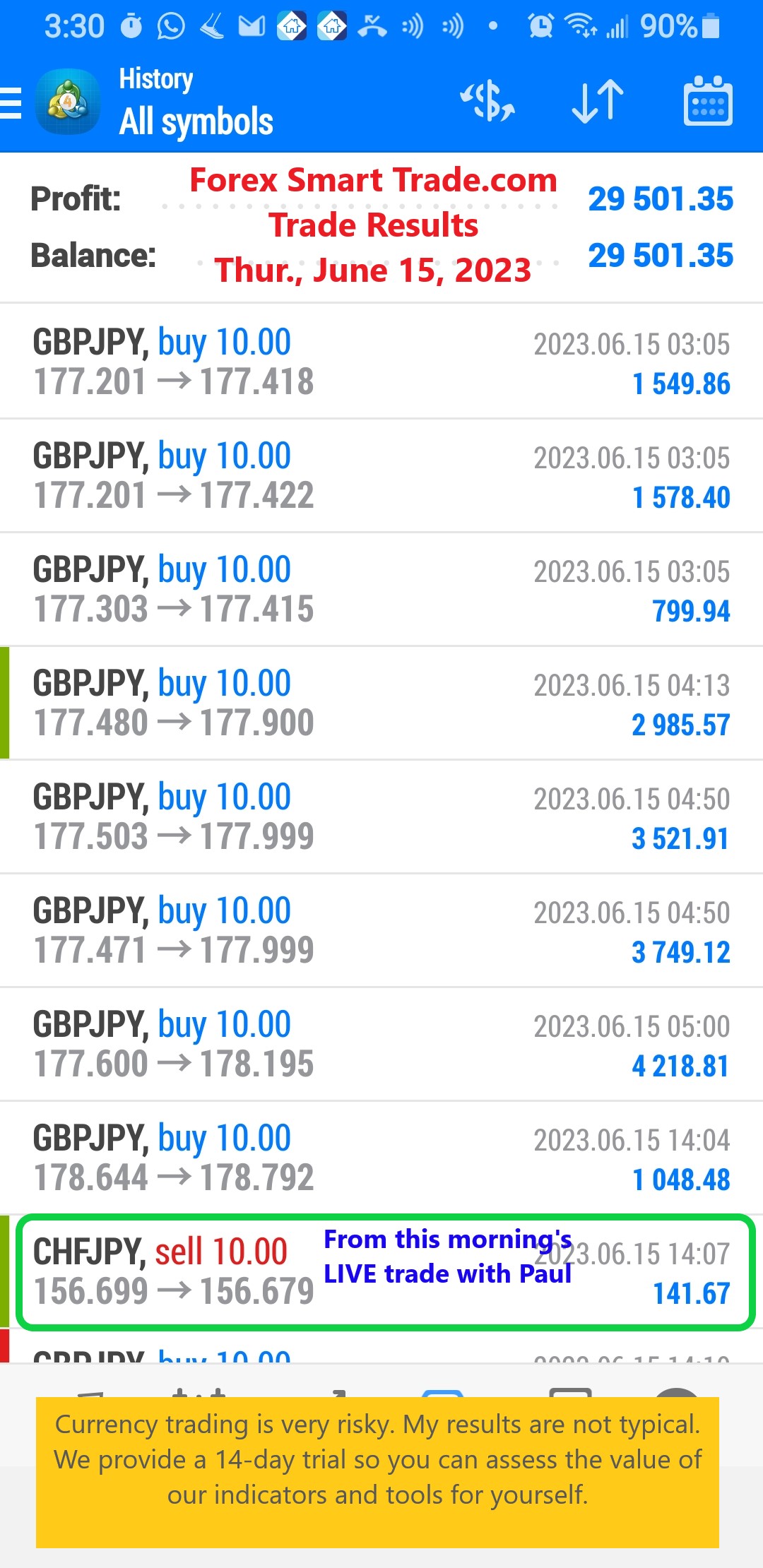

Forex Smart Trade Results, Thursday, June 15, 2023 – $29,501

How to Use the Stochastic Indicator. The Stochastic oscillator is another technical indicator that helps traders determine where a trend might be ending. The oscillator works on the […]

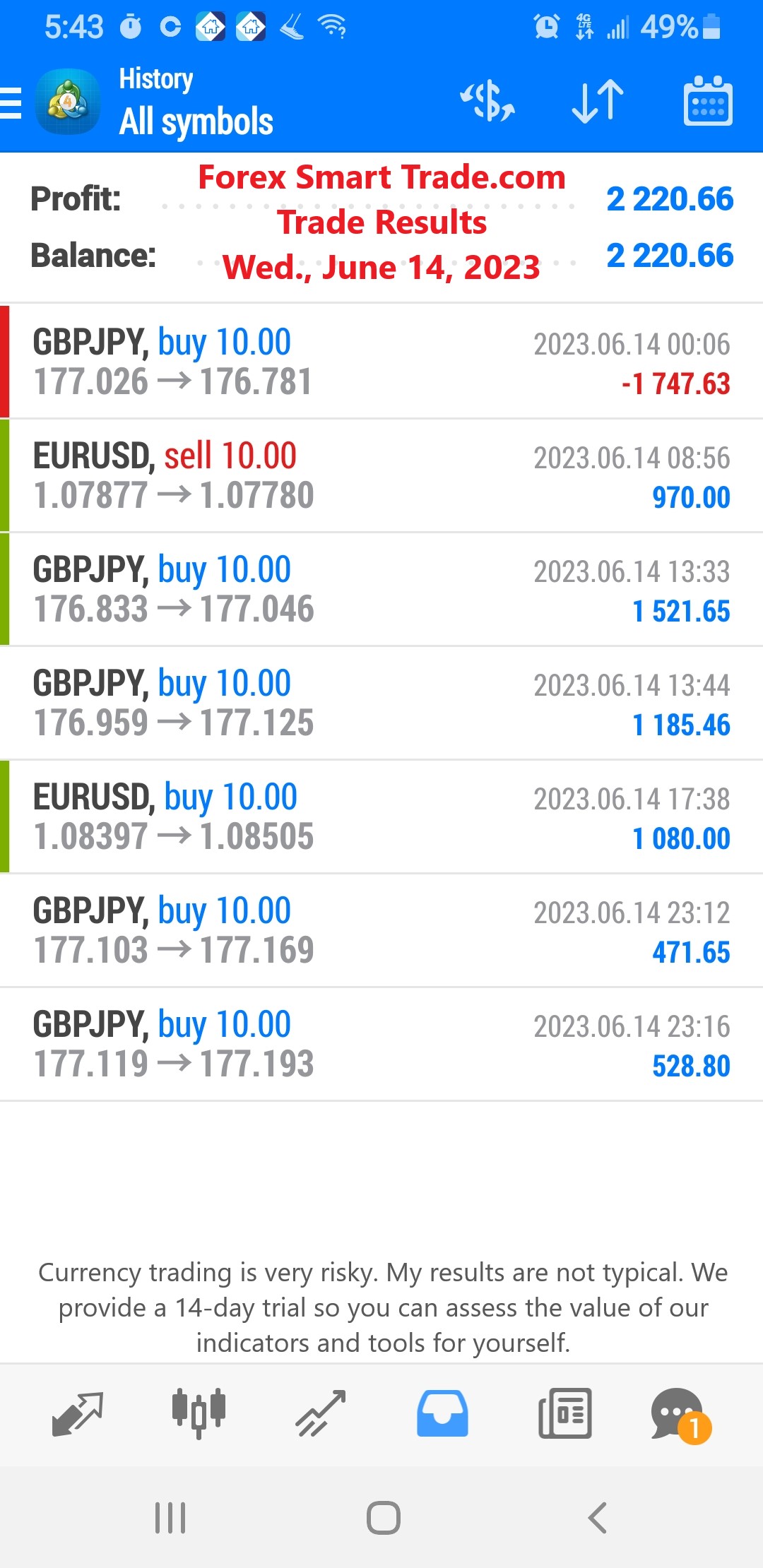

Forex Smart Trade Results, Wednesday, June 14, 2023 – $2,220

How to use Parabolic SAR to exit trades. Now let’s review how to use parabolic SAR to exit trades. You can also use Parabolic SAR to […]

Forex Smart Trade Results, Tuesday, June 13, 2023 – $11,055

How to Use Parabolic SAR. Let’s take a look at how to use parabolic SAR. Up until now, we’ve looked at technical indicators that mainly focus […]

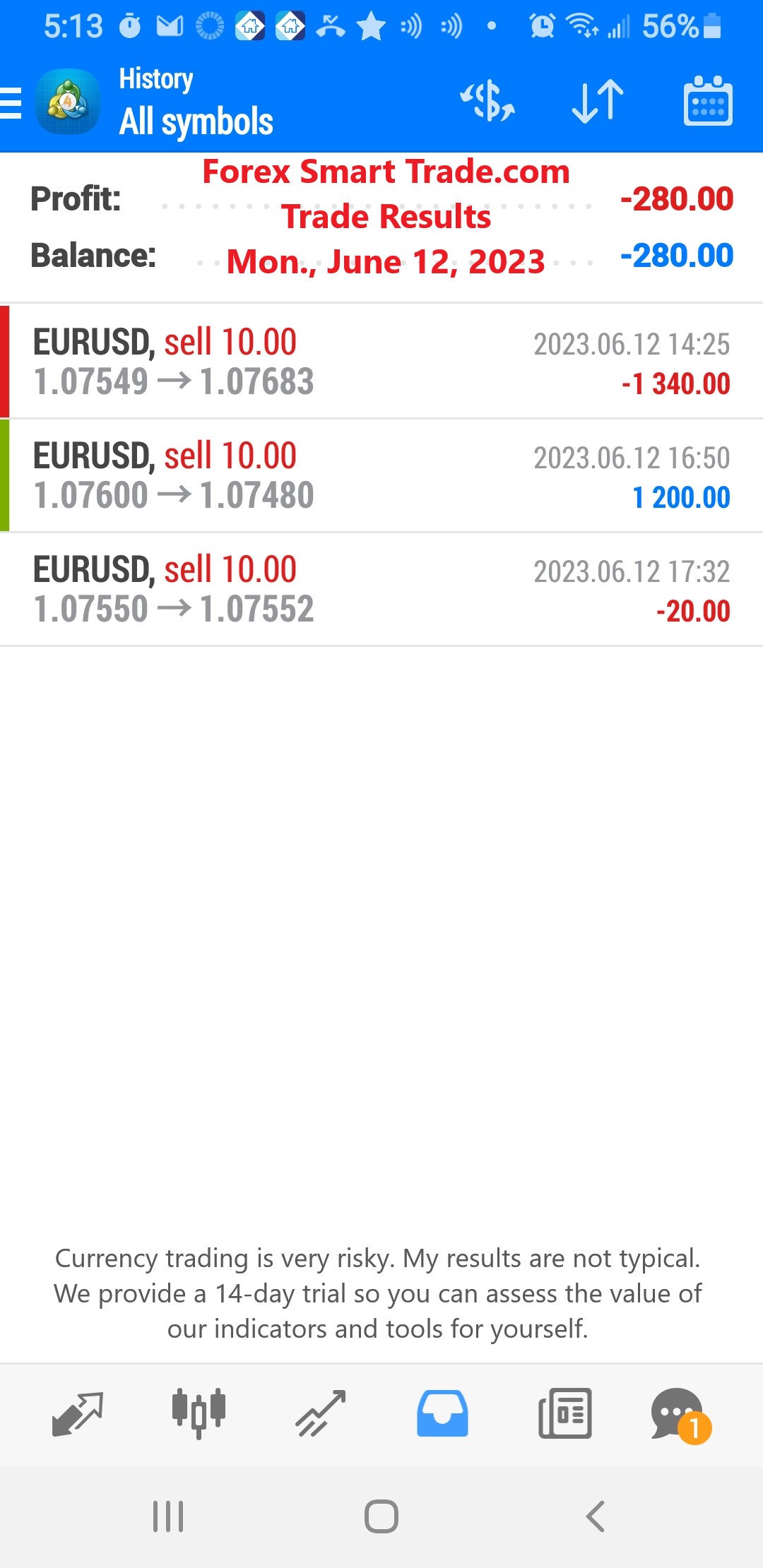

Forex Smart Trade Results, Monday, June 12, 2023 – ($280)

How to Trade Using MACD. Let’s take a look at how to trade using MACD. Because there are two moving averages with different “speeds”, the faster […]

Forex Smart Trade Results, Friday, June 9, 2023 – $9,867

The MACD Line. The Signal Line is the moving average of the MACD Line. When looking at the indicator, we consider the Signal Line the “slower” moving average. […]

Forex Smart Trade Results, Thursday, June 8, 2023 – $0

How to Use the MACD Indicator. Let’s take a look at how to use the MACD indicator. What is MACD? MACD is an acronym for Moving Average Convergence Divergence. This technical […]

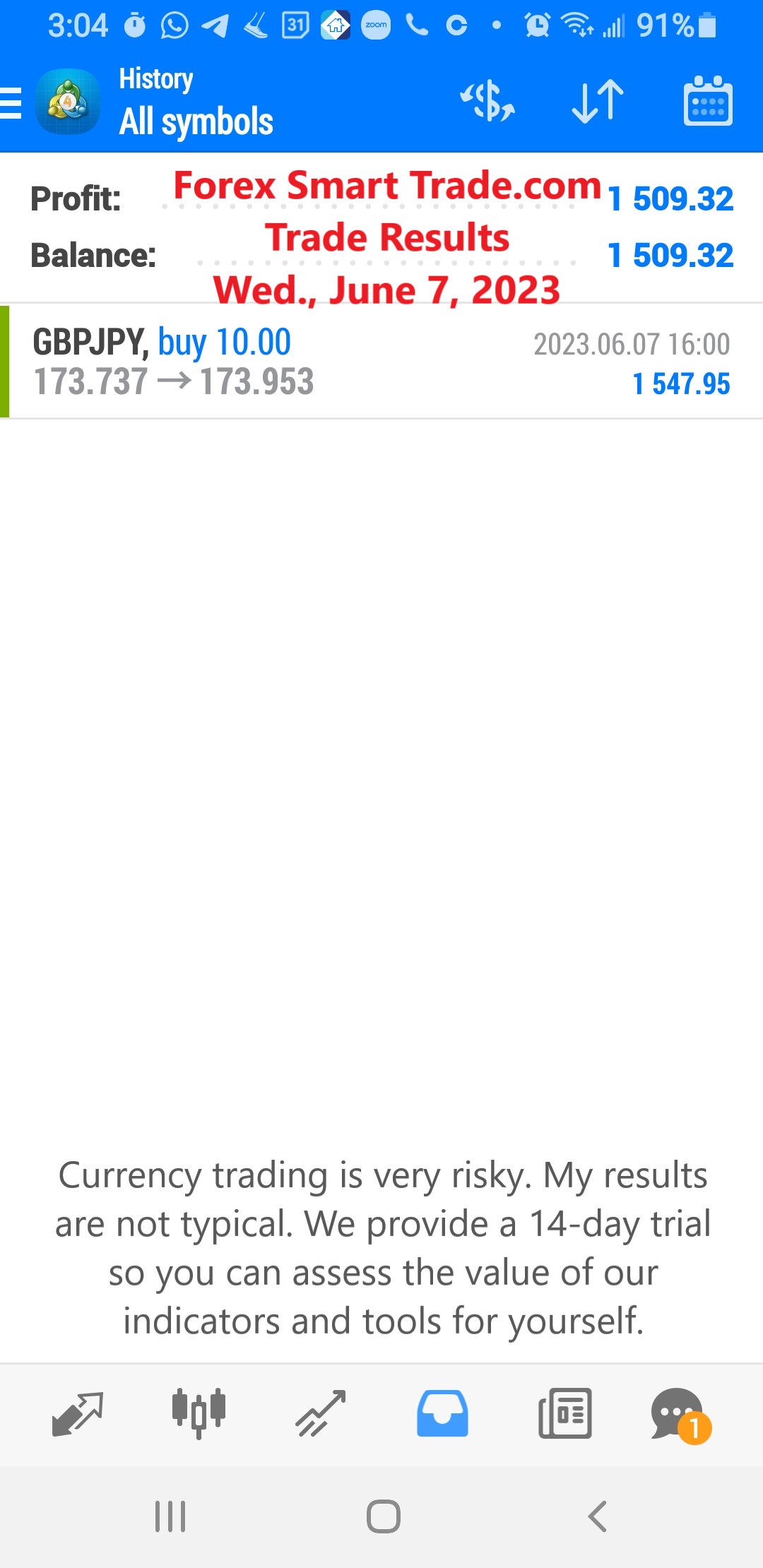

Forex Smart Trade Results, Wednesday, June 7, 2023 – $1,509

How to Trade Breakouts Using Keltner Channels. Now let’s examine how to trade breakouts using Keltner channels. Breakouts from the Keltner Channel act as strong hints […]

Forex Smart Trade Results, Tuesday, June 6, 2023 – ($1,137)

How to Trade Forex Using Keltner Channels. Now let’s take a look at how to trade forex using Keltner channels. Keltner Channels show the area where […]

Forex Smart Trade Results, Monday, June 2, 2023 – $6,513

How to Use Keltner Channels. Keltner Channels is a volatility indicator introduced by a grain trader named Chester Keltner in his 1960 book, How To Make Money in […]

Forex Smart Trade Results, Friday, June 2, 2023 – $11,054

Bollinger Squeeze. The “Bollinger Squeeze” is pretty self-explanatory. When the bands squeeze together, it usually means that a breakout is getting ready to happen. If the […]

Forex Smart Trade Results, Thursday, June 1, 2023 – ($881)

More on How to Use the MACD Indicator. More on how to use the MACD indicator. The Signal Line is the moving average of the MACD Line. When looking […]